Is the FCA developing teeth and beginning to become an enforcer after all?

SM&CR has been part of the regulatory landscape for dual-regulated firms since 2016 and solo-regulated firms since 2019. A major part of the regime is about the accountability of senior managers, with the threat of personal sanction from the regulator or, in the worst cases even criminal sanction (for certain firm types). So, if SM&CR was designed to hold the financial services industry to account, what has been the result?

In October last year, the consultancy Bovill used a Freedom Of Information (FOI) request to ask the FCA questions about their enforcement activity. Their request showed that from March 2016 to September 2020, the FCA opened 34 investigations. Of these, 11 were closed without action and only 1 resulted in a fine. At the time of the request, the remainder were still under investigation. Bovill’s CEO, Ben Blackett Ord, said; “We don’t believe that the low number of enforcements is a sign that SMCR has been an effective deterrent for Senior Managers, since the cases closed without action to enforcement ratio is high”. He went on to say that enforcement investigations often taking between two to three years to conclude was painfully slow and that the longer these investigations took, the less effective they were at holding people to account.

The questions raised by the Bovill FOI request is supported by evidence from three major financial scandals, overseen by the FCA namely: the HBOS ‘systemic and widespread/ mistreatment of small and medium sized firms between 2008-13, the role of the FCA in the oversight and suspension of the Woodford Equity Income Fund and, most recently, the failures of the FCA’s investigation department into the London Capital & Finance fund (LC&F).

Combined, these amount to a significant ‘charge sheet’ against the FCA and begs the legitimate question; exactly how credible is the FCA as a deterrent against malpractice? Certainly, Tory MP Kevin Hollinrake, who co-chairs the All-Party Parliamentary Group on Fair Business Banking, has his doubts. He recently said: “In terms of identifying and chasing down really egregious behaviour, they have an appalling track record, even when stuff is presented on a plate in front of them as it was with LC&F, Woodford and HBOS Reading”.

Whilst this may appear bleak, there are some counter indicators that point out that the FCA is moving forwards towards better control of the industry

So where does this leave with FCA and its flagship SM&CR regulation?

Whilst this may appear bleak, there are some counter indicators that point out that the FCA is moving forwards towards better control of the industry. Let me suggest three:

1.Skilled Persons Reviews

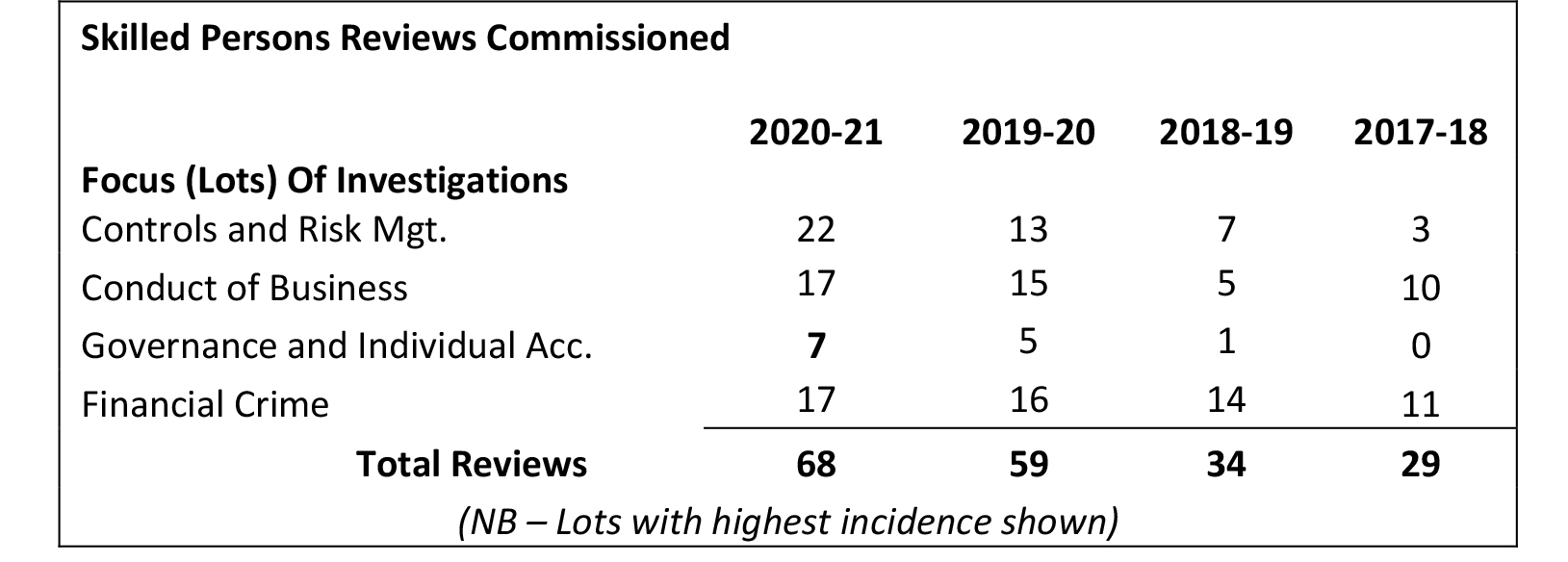

Skilled Persons Reviews, commonly known as S166’s, are commissioned by the FCA when it suspects a firm is breaching its duty of care to customers, market competition or both. When initiating a S166, the FCA, or the firm (depending of the complexity of the review) instructs the ‘skilled person’, i.e. an approved organisation with proven regulatory expertise, to focus their investigation on a particular area (known as a Lot) of the firm’s business practices.

Historically, S166 Lots have been dominated by Financial Crime, Management of Client Assets and to a lesser extent, Controls and Management of Risk. However, in recent years, the balance of S166 investigations is shifting, see below:

These statistics indicate that the FCA is now focusing on Conduct of Business and Governance and Individual Accountability as well as Controls and Management Of Risk. Interesting!

2. Approved Persons Applications – Withdrawn Applications

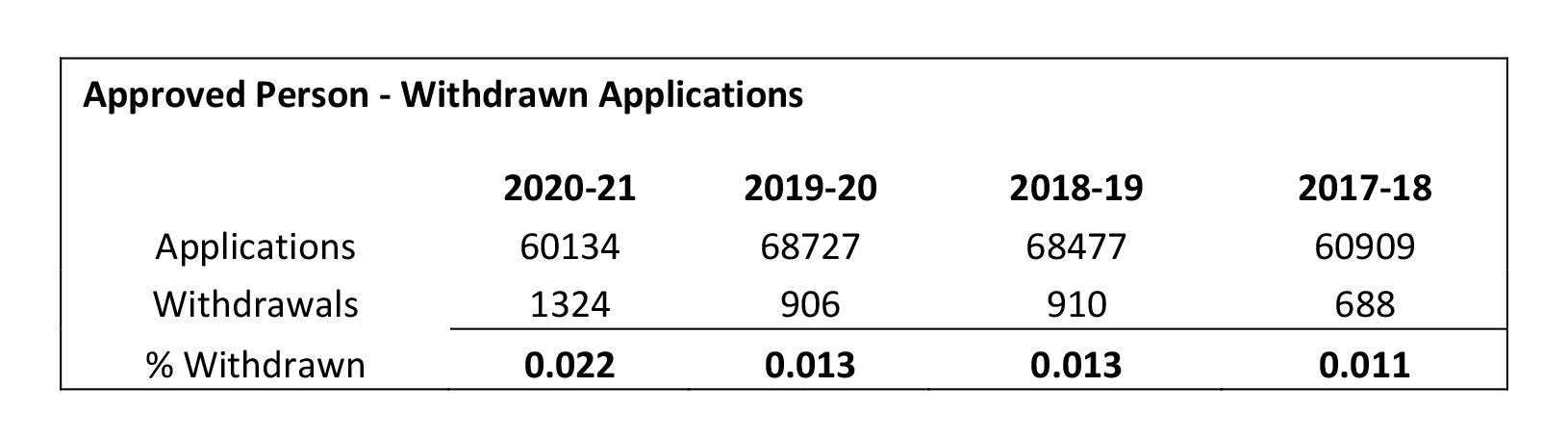

Being approved by the FCA under SM&CR is an integral part of a firm’s assurance that its key customer-facing staff (where required) and its executives meet the competence and integrity standards required by the industry. The applications process has three potential outcomes; approved, rejected or withdrawn. Having an application rejected is a significant blemish on a person’s CV, so is a very rare occurrence, e.g. only two between 2017 and 2021. Knowing this, if the FCA believes an application is incomplete or tells a story about a person that falls below the FCA’s standards, it can suggest the firm withdraws the application.

Looking at the FCA’s annual KPI reports, it is possible to investigate this statistic, see below:

Of course, this table needs to be treated with caution, i.e. the withdrawn numbers are very low, it is unclear what the number of withdrawn cases that are successfully resubmitted and finally that 2020-21 may be a ‘blip’ in the annual average. However, when put alongside the other indicators, it may well indicate increasing standards by the FCA or a desire not to compromise their existing standards.

3.New Leadership

The final area of potential indicators that the FCA is becoming more interventionist at managing standards in the industry lays with the FCA itself.

Last year, Andrew Bailey was replaced at the FCA by Nikhil Rathi with a brief to shake up the organisation. Indeed, the recommendations in the Treasury Select Committee’s newly published report into the collapse of LC&F lists a series of recommendations that the FCA needs to undertake to transform its culture and practices and, in turn, its supervision of the industry.

Much is expected of Rathi. As one senior bank executive recently said, “Rathi is a class act, smart and very well versed in navigating Whitehall.” However, whilst the challenges are large, he does bring the hope of change inside the FCA and early signs are encouraging, e.g. review of the current supervisory structure, a focus on big data and the use of data analytics within the regulator to help identify potential risks before they crystallise1.

As I conclude this article, the old phrase ‘one swallow does not make a summer’ comes to mind. However, in my view, there are a number of indications that the FCA is beginning to become the enforcer of regulatory standards that we have all expected, indeed the industry needs. Let’s hope we see more swallows soon!

[1] Worksmart’s RegTech solutions such as dedicated our SM&CR, complaints, QA and T&C systems, are key to ensuring that the underlying processes that ensure compliance are in place, so ensuring no contra-indicators are picked up by the FCA.

Our sponsors help bring T-CNews content to you for free