“Solvency II sets out regulatory requirements for insurance firms and groups, covering financial resources, governance and accountability, risk assessment and management, supervision, reporting and public disclosure.” (source: The Prudential Regulation Authority website).

On 1 January 2016, Solvency II introduced a more risk-based system of supervision for insurance firms across all 27 European Union (EU) member states.

Following the UK’s withdrawal from the EU (Brexit), the Prudential Regulation Authority (PRA) in conjunction with HM Treasury reviewed Solvency II with a view of making the provisions more relevant to the UK whilst maintaining the protections afforded by Solvency II.

In addition to fully harmonising regulation across the EU, Solvency II imposes stricter requirements on firms to protect policyholders via adequate capital and consistent risk management standards. Solvency II continues to apply to all UK insurance firms. The PRA has updated its website to reflect the legal and regulatory framework that is applicable after 1 January 2021, which effectively ‘onshores’ Solvency II requirements into the UK. You can read the latest PRA Solvency II updates here which include the results of the Bank of England’s annual stress-testing exercises and the progress towards Solvency UK.

Who does Solvency UK apply to?

Solvency II applies to all EU insurance firms with a gross premium income that exceeds €5 million or gross technical provisions in excess of €25 million. Following the UK’s exit from the EU, the provisions of Solvency II have been adopted into UK regulation. Technical provisions are the amount that a firm sets aside in reserve to fulfil its insurance obligations.

In addition to fully harmonising regulation across the EU, Solvency II imposes stricter requirements on firms to protect policyholders via adequate capital and consistent risk management standards.

Under Solvency UK, insurers need enough capital to have 99.5% confidence that they could cope with the worst expected losses over a year. The PRA estimates that about 450 UK firms are subject to Solvency UK requirements.

To facilitate the transition of Solvency II to Solvency UK, the PRA has published two consultation papers:

CP12/23 – “Review of Solvency II: Adapting to the UK Insurance Market” and

CP19/23 – “Review of Solvency II: Reform of the Matching Adjustment”.

The PRA has stated the implementation date for the majority of the reforms will be at which point all references to Solvency II will be changed across to Solvency UK. The PRA has recommended that firms should take note of the consultation papers and begin to prepare for the new provisions.

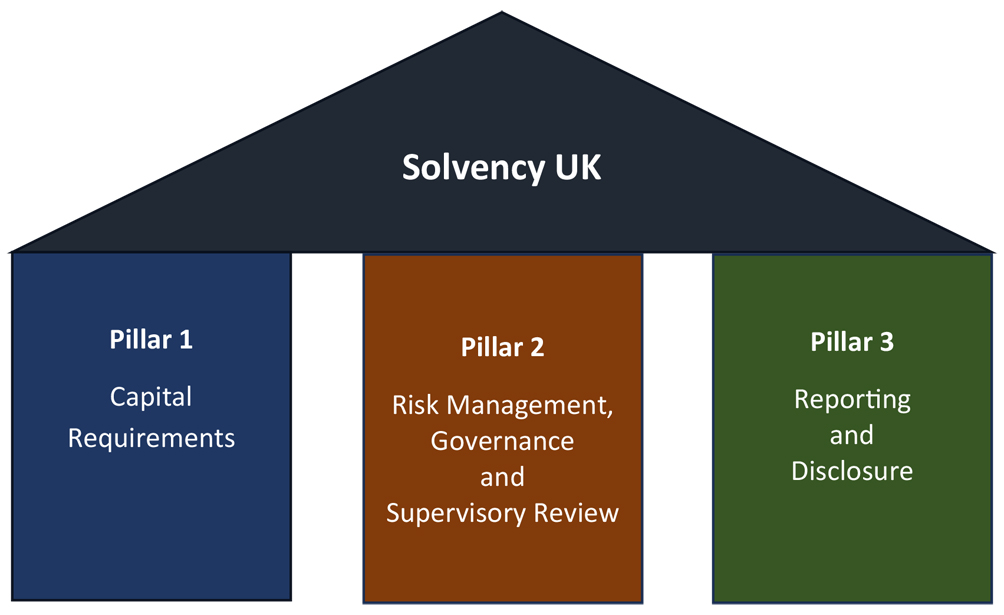

The Solvency UK framework has been grouped into three separate “pillars” of capital and risk management.

Pillar 1

Covers the capability of an insurer to demonstrate that it has adequate financial resources in place to meet all its liabilities.

Pillar 2

Defines requirements for the governance and risk management frameworks that identify and measure the risk against which capital must be held, as well as for the effective supervision of insurers. This ensures that insurers’ businesses are managed to a high standard.

Pillar 3

Focuses on disclosure, reporting and transparency requirements around these risks and capital requirements.

Minimum capital requirement

Firms must maintain sufficient capital to cover two thresholds, the minimum capital requirement (MCR) and the solvency capital requirement (SCR).

MCR

The MCR denotes a level below which policyholders would be exposed to an unacceptable level of risk. It represents the potential amount of own funds that would be consumed by unexpected large events whose probability of occurrence within a one-year time frame is 15%.

The MCR must be calculated quarterly in accordance with a standard formula set by the PRA on a “value at risk” measure, which is intended to reflect the risk associated with a portfolio of assets and liabilities. The MCR cannot fall below 25% or exceed 45% of an insurer’s SCR.

SCR

The Solvency Capital Requirement (SCR) is the quantity of capital that is intended to provide protection against unexpected losses over the following year whose probability of occurrence within a one-year time frame is 0.5% – up to the statistical level of a “one in 200-year event”. This robust requirement is designed so that insurers should be able to withstand all but the most severe of shocks.

The intention is for the SCR to reflect the real risk profile of a firm, taking into account insurance risk alongside market risk, credit risk and operational risk.

A firm’s SCR must correspond to the value-at-risk of its basic own funds subject to a confidence level of 99.5% over a one-year period.

When calculating the SCR, firms must take account of the effect of risk-mitigation techniques, provided that credit risk and other risks arising from the use of risk-mitigation techniques are properly reflected in the SCR.

Quality of capital

The prudential regulation of insurers under Solvency II notes that “even if the quantity of capital held by an insurance firm is considered to be sufficient, if that capital is not of an appropriate quality, then it may not be able to absorb losses effectively.” Under Solvency II, capital is classified into three tiers.

- Tier 1: Highest quality of capital and must be able to absorb losses on a day-to-day going concern basis.

- Tier 2: Lower quality and only needs to absorb losses on insolvency.

- Tier 3: Lowest quality of capital permitted and has only limited loss absorbing capacity.

Pillar 2: Risk Management, Governance & Supervisory Review

Pillar 2 is based on four building blocks of Governance, these are:

- A risk management system that models potential risks in addition to managing them.

- Own Risk and Solvency Assessment (ORSA) and capital management.

- Policy, processes, and procedures that must be fit for purpose, and enforced.

- Key functions covering

- Risk management

- Compliance

- Actuarial

- Internal audit

Solvency II requires:

A firm to establish and maintain an effective risk management system. At a minimum, this should encompass the following risk categories:

- Underwriting and reserving

- Asset and liability management

- Investments

- Liquidity and concentration risk management

- Operational risk management

- Reinsurance and other risk mitigation techniques

To be effective, the risk management system should take account of the strategies, processes, and reporting procedures necessary to identify, measure, monitor, manage and report the risks to which the firm could be exposed. The system should be documented, regularly reviewed, and fully integrated into the firm’s decision-making process.

and

A specific Risk Management Function (RMF) to be in charge of ensuring that the risk management system remains fit for purpose

A firm must ensure that it has an effective system of governance in place, which provides for sound and prudent management of the business.

At a minimum, this should include a transparent organisational structure, with a clear allocation of responsibilities and segregation of duties, coupled with an effective system for communicating information across reporting lines. This links well with the principles of the Senior Managers and Certification Regime (SMCR), in which firms are required to prepare a Responsibilities Map for the business and individual Senior Managers are required to hold a Statement of Responsibilities.

The firm’s governance rules should be documented and approved by the Board and reviewed at least annually.

- Contribute to the effective implementation of the risk-management system, including risk modelling.

- Submit an actuarial function report to the Board annually.

Pillar 3: Reporting & disclosure

The requirements are designed to foster market discipline and provide supervisors with the information needed for effective and proportionate supervision. As the prudential regulation of insurers under Solvency UK states, “Solvency UK introduces new reporting and disclosure requirements for firms, with the aim of improving the availability of information to the market”.

Firms must produce a Solvency and Financial Condition Report (SFCR)

- Firms are required to disclose this report publicly and report it to the PRA on an annual basis.

- The SFCR includes qualitative and quantitative information.

In the SFCR, a firm needs to clearly explain aspects of its approach to Solvency UK, such as the use of an internal model and any non-compliance with regulatory solvency requirements.

In addition, firms must comply by the Rules set out in PRA Policy Statement PS2/15 in relation to submitting National Specific Templates.

Firms should also be aware of the PRA’s expectations in SS25/15 “Solvency II: regulatory reporting internal model outputs”, which contains templates and log files that the PRA expects firms to use when submitting regulatory reports on their internal model outputs.

The PRA proposes to update SS11/16 “Solvency II: External audit of, and responsibilities of the governing body in relation to, the public disclosure requirement” to reflect the proposed changes to the group templates disclosed in the SFCR.

Ahead of 31 December 2024, firms should review the changes brought about by the transition from Solvency II to Solvency UK and ensure their systems and controls are fit to meet the new regime.