We are almost two months on from 31 July 2023 deadline for implementing all the elements of Consumer Duty into our businesses. How are we doing?

As a Compliance Consultant, Consumer Duty is the gift that keeps giving. It has provided a lot of work for at least the past year and should provide a steady stream for some time to come. Or at least it should, as firms should be regularly reviewing the processes for advice and reviews, communications, products and pricing structures. Do those things seem familiar? They should.

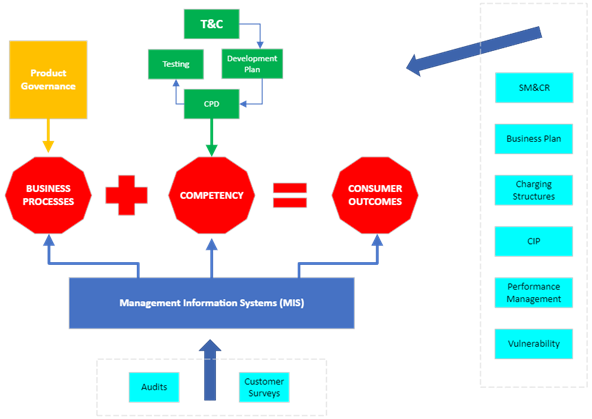

As a reminder, here are the four outcomes for Consumer Duty.

- Products and services: are designed to meet the needs, characteristics and objectives of a specified target market

- Price and value: Products and services provide fair value with a reasonable relationship between the price consumers pay and the benefit they receive

- Consumer understanding: Firms communicate in a way that supports consumer understanding and equips consumers to make effective, timely and properly informed decisions

- Consumer support: Firms provide support that meets consumers’ needs throughout the life of the product or service

On top of that, the Consumer Duty also brought Vulnerable Clients and Sustainable Investment into the mix for advisers to build into their advice processes.

All the firms that I deal with have undertaken very detailed reviews of their business and have been keen to be entirely compliant with Consumer Duty. Many have agonised about just how much information and evidence that they need to keep.

On top of that, the Consumer Duty also brought Vulnerable Clients and Sustainable Investment into the mix for advisers to build into their advice processes.

I have recently written a training session that encompasses SM&CR, Consumer Duties and Vulnerable clients and delivered this to my client firms. I was pleasantly surprised to find that they all dovetailed quite nicely with almost seamless segues between the three subjects. It was almost as if the FCA had been forward thinking enough to have foreseen such a training module. I am going to put the training presentation onto my website www.thecattseyeview.co.uk shortly.

Following on from the training, one of the larger firms has set up whole processes around the identification of vulnerable clients and what they are going to do to accommodate them in future. The firm has also designated some more experienced staff members to be Subject Matter Experts to help their colleagues in this field.

The Sustainable Investment end of this deal is more difficult. The FCA has taken quite a long time to try to give some definition to Sustainable Investment that everybody can understand. The labelling system is still in throes of negotiation and consultation, although we have been promised that guidance will be forthcoming in Q4 this year. It better be so easy that even a compliance consultant can understand it after the amount of time and consideration that is going into it.

This is not helped by the recent headlines with the Government back-tracking on previous promises made and the dates that things are scheduled to happen. This makes advisers nervous about recommending sustainable funds because of this uncertainty. This is coupled with the relatively poor short-term performance of funds that do not contain oil and power stocks that have thrived in the last 18 months.

What people do not seem to realise is that Sustainable Investment and planning is for longer-term. We have a government that is planning for the next few months in preparation for an Election. It seems to be pandering to certain elements of its own constituency and pumping out all sorts of (mis)information in the press to try to explain its thinking.

We had the by-election in Uxbridge and South Ruislip apparently decided by a protest vote about the Ultra Low Emission Zone being extended to Greater London. Labour tried to stop that roll-out because it might mean it lost that seat. You cannot get much more short-term than that! The worst excuse ever!! The argument that why should we bother because China and India are still pumping out carbon emissions is ludicrous. Their emissions have no impact on cleaner air in London suburbia.

On the positive side, the first week in October is the UKSIF Good Money Week. Various conferences are planned for that week and represent a great opportunity for advisers to learn about Sustainable Investment from real experts and not just dabblers like me. For information about the event, go to https://goodmoneyweek.com/

My revisit of Sustainable Investment is due to be published this week by IFA Magazine and will be available on their website https://ifamagazine.com/publications/ .

At least I know that Consumer Duty and the elements within it will keep me busy for some time to come.