As firms move into the final stages of preparation for the implementation of the incoming Consumer Duty (CD) regulation, I thought it would be interesting to think ahead and start considering life post 31st July 2023 and particularly consider what life might be like for a firm’s CD Champion who, ultimately is responsible for championing the improvements and enhancements demanded of a business by CD.

In many organisations it is likely that the CD Champion will be a NED and therefore, will only operate in the business on a very part time basis. However, there will be some smaller organisations that don’t have NEDs and so will appoint someone with relevant seniority within the business to act in this role. Regardless of whether the CD Champion is a non-executive or an employee, it is worth remembering that the FCA set the expectation that firms should appoint this champion at board level or equivalent. Although many industry commentators felt the CD Champion should be a “prescribed responsibility” under SM&CR, the FCA have been clear that they consciously chose not to formalise the requirement in this manner. Instead, they have made their view clear that the champion role is there to support the Chair and CEO of the business in raising the Duty in all relevant discussions, to lead challenge of the firm’s management on how the Duty has been embedded and ensuring the correct focus is maintained around consumer outcomes.

So that said, what will the CD Champion need from the business?

They will need to not only have confidence in any data / dashboards being provided to them to evidence that the firm is delivering good customer outcomes they should also be keen to consider the supporting structures, policies and processes designed to deliver and, where needed, respond to any data provided. Once provided, this will enable the CD Champion to ensure that they deliver against the FCA’s expectations around supporting the firm’s Chair and CEO in meeting their regulatory obligations.

The role of the CD Champion is a vital one in helping firms maintain their required focus in this area. Having a rounded set of data that monitors performance is key alongside having the confidence that supportive structures, policies, and processes are in place to respond to the need for change

Putting myself in their shoes, I wondered what I would request, demand even, to ensure that if I was a NED, CD Champion of a large firm post 31st July ’23, that I could feel comfortable that I was discharging my CD champion role as expected. Given the mountains of information available from the regulator, trade bodies, law firms, consultants etc., like everyone else in the industry, I could hardly complain about being underinformed. Indeed, thinking about it, the exact the opposite is the issue, i.e. how to make sense of it all as a means of forming a plan of action. Distilling this information available within the industry was surprisingly challenging due to the volume of it, however I eventually settled on the following four areas. Taking each in turn:

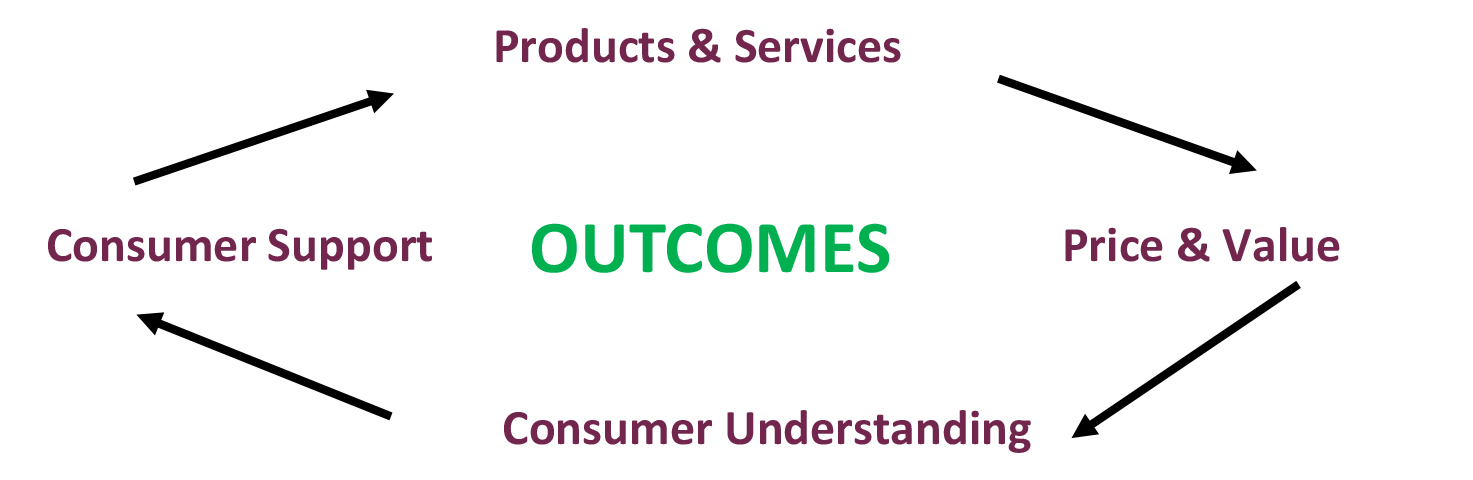

- Customer Outcomes

The first, and most obvious, place to start is with the four customer outcomes. In my view, the CD Champion would want to know how clearly the firm understands how it behaves against each outcome, and, for me, would find this out by the clarity and detail of the answers to the following questions:

Products and Services:

- Are all the firm’s products and services identified?

- Does each of these products and services have a clear target market and are designed to meet the needs of those consumers, (whether marketed directly to or distributed face to face (or via call centres) retail consumers)?

- Are the distribution strategies and channels appropriate for each product / service?

- To what extent has the firm considered all of this in relation to potential foreseeable harm and particularly vulnerability?

- What are the approval points for products and services prior to launch? And who has the go/no go authority?

- How often are the products or service’s performance reviewed and, if necessary, adjusted or withdrawn?

Fair Value:

- How well are the cost elements of each product or service identified, broken out and quantified?

- What is the pricing for each product or service, (by channel and customer group)?

- How developed is the information sharing between the manufacturer and distributor for each product or service?

- How reasonable is the price versus the costs of each product or service relative to the proposed benefits to each customer group?

- Are the impacts of the cumulative costs of products and services on consumers considered (distributors)?

- How often and how thoroughly are these cost / pricing analyses (value assessments) conducted?

- And how is this data used in making decisions about the product or service throughout its lifecycle?

Consumer Understanding:

- What information is provided to each consumer group for a product or service, and at what stage of the sales cycle, e.g. layering?

- How sensitive is this information to the power imbalances between the firm and the consumer, i.e. are these imbalances reflected in the type of information, how and when it is communicated?

- Are appropriate frictions built into the process?

- Is the sales process and information sensitive to behavioural economics, e.g. biases?

- How thoroughly has this information been tested on all the different targeted consumer groups, including those with vulnerabilities?

- How often are these product / service information sets tested to ensure continued appropriateness?

Consumer Support:

- How defined are the firm’s post sale support processes mapped, i.e. by product / service, by customer group (including those with potential or emerging vulnerabilities) etc.?

- What evidence is in place to explain / justify the appropriateness of these processes?

- Is information provided at different points to help build consumers’ understanding of the product / service?

- Are frictions built into the post-sale process to prevent consumers making potentially detrimental decisions?

- What sensitivities are built into the post-sale process to identify changes in consumers’ circumstances and so increased vulnerability? What processes are in place to support vulnerable consumers?

- How often are these processes reviewed / evidenced and decisions about their sustained suitability made?

To be honest, the questions could go on and on. For me, however, these questions will identify the seriousness to which the firm has considered consumer outcomes, and so the extent to which the CD Champion should be comfortable.

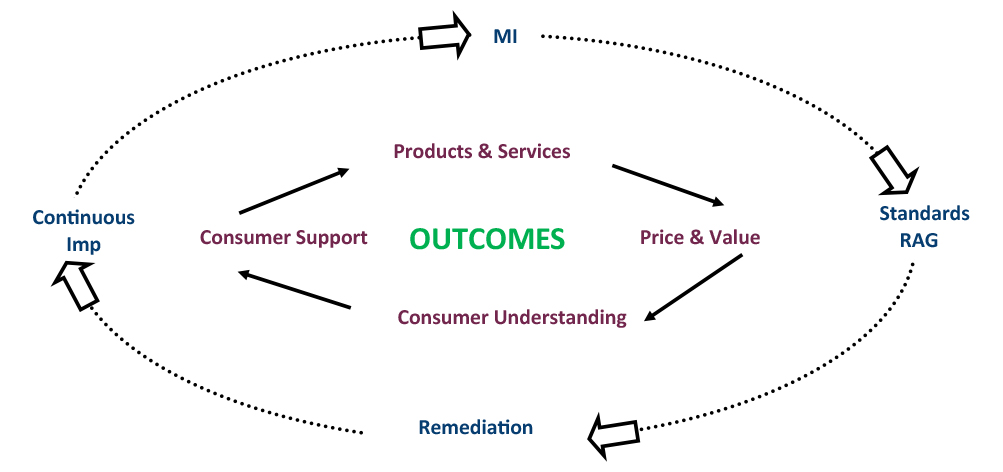

- Data & MI

The second area which, in my view, CD Champions should focus on is the data and MI the firm collects because, without good MI, the firm has a patchy, or worse still, a skewed understanding of performance against the consumer outcomes. Allied to this, it is equally important for the CD Champion to understand exactly how this information is used in ensuring the firm continues to deliver good consumer outcomes. Again, for me, the areas the CD Champion should ask questions about are:

- What data is collected against each consumer outcome? Is the data both quantitative and qualitative? How often is this data collected and how is it aggregated?

(The FCA provides suggestions on the information to use: FG22/5 – section 11:33).

- What level of granularity does the data provide for each of the products and customer groups, particularly those with potential or emerging vulnerabilities?

- What are the standards for each dataset, i.e. what does ‘good’ mean, what does ‘reasonable’ mean? How well does the data gathered provide insight into the standards?

- What are the tolerances, i.e. RAGs, for each of these standards? How do these tolerances balance the commercial needs of the firm versus the risks of foreseeable harm?

- If the data leads to action being taken, what are the corrective actions and how are these actions monitored, and the results of improvement evidenced?

- How is continuous improvement provoked? By whom, when and why? Again, how is continuous improvement tracked and the results evidenced against good consumer outcomes?

Interestingly, in a recent webinar on CD run by PIMFA and Worksmart, attendees were asked about their confidence in their firm’s dataset for monitoring compliance with CD. The overwhelming view was not encouraging, with 57% saying they were only ‘somewhat confident’, their firm’s dataset, despite the firm ‘having made a number of improvements’. And a further 32% said that although their firm’s dataset ‘had improved’, they had ‘little confidence’ in it. When probed, attendee’s biggest concern, 57%, was the ‘granularity of the available data’. This may well be an unrealistic sample, however, if these figures are in any way indicative of what is going on in the industry, it does not bode well!

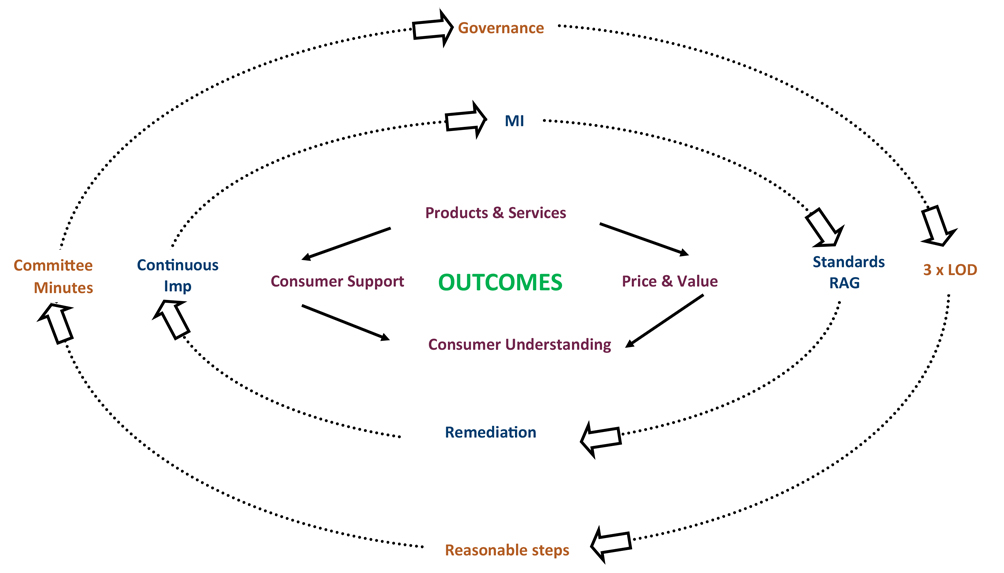

- Governance

The third, and critical, area for incoming CD Champions is governance because, although good MI is a precursor, without good oversight, the firm is at real risk of non-compliance. So, what should the incoming CD Champion be looking for:

- How are the three LODs operating? Are their responsibilities effectively allocated and segregated? What responsibilities, including the lines of communication are defined between these areas and the CD Champion?

- How independent are the second and third LODs? Are they staffed with people of sufficient experience to make important, potentially challenging, recommendations?

- What MI / dashboards are they being provided with? Does the second LOD have sufficient information to be able to provide senior management, and the FCA if requested, an opinion on the firm’s conformance with CD?

- What evidence is there from senior management that CD is being taken seriously on a day-to-day basis by senior management, e.g. SMF’s reasonable steps records, committee minutes etc?

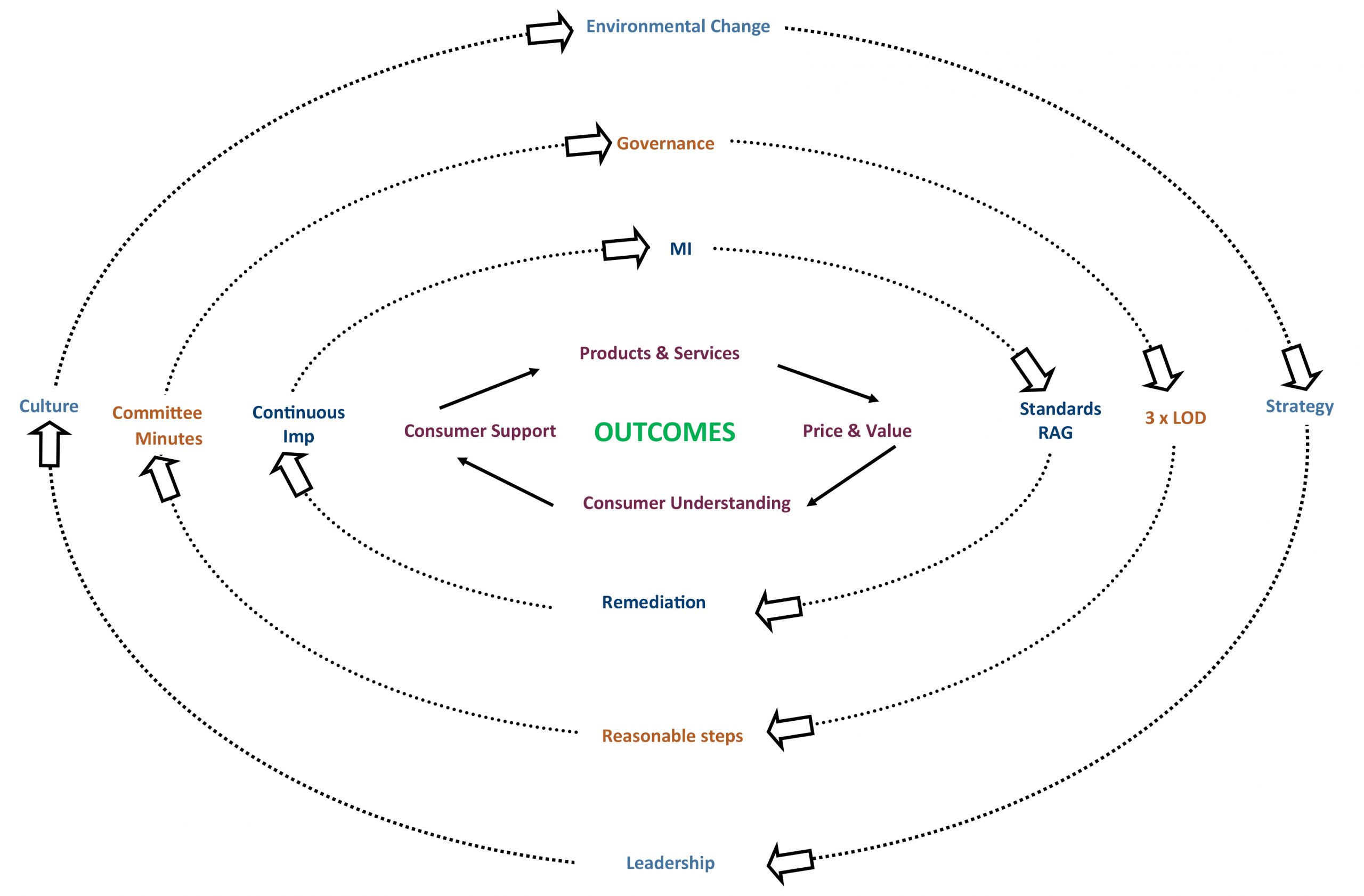

- Culture & Strategy

The fourth and final area is, perhaps, the most challenging for firms and CD Champions to understand in relation to CD. The FCA has talked about culture being the single most important factor underpinning achieving good outcomes for consumers and preventing foreseeable harm. As such, it should be ‘front of mind’ for incoming CD Champions. However, it is notoriously difficult to pin down. Despite this, CD Champions should look for indicators in the MI they receive about culture, specifically:

Purpose:

- Is there a communications plan in place that states the firm’s purpose and strategy and how it relates to and supports CD?

- Are changes to strategy sensitive to and consistent with CD, e.g. deteriorating economic conditions and strategy changes that take vulnerability into account?

Leadership:

- As senior management are the creators and custodians of culture, is there evidence of senior managers acting to support examples of good behaviour and ‘calling out’ examples of bad?

- Are the firm’s leaders behaving and making decisions that clearly demonstrate their support for and commitment to good customer outcomes?

Governance:

- Are there policies in place that inform and guide staff to the behaviours expected of them under CD?

- Are there monitors in place to identify the cultural risks to preventing foreseeable harm?

People:

- Are the principles and key components of CD integral to staff training at all levels?

- Do the firm’s recognition and reward processes promote best practice CD behaviour?

The role of the CD Champion is a vital one in helping firms maintain their required focus in this area. Having a rounded set of data that monitors performance is key alongside having the confidence that supportive structures, policies, and processes are in place to respond to the need for change. With these in place, the CD Champion will be able to engage with the CEO and Chairman in meaningful discussions about their firm’s obligations under CD. Let’s hope that the projects designed to ready firms for 31st July put their CD Champions in a good place by having answered these questions on their behalf. If so, they can be the positive influence for change envisaged by the FCA.