This is quite a hot issue. The FCA has undertaken a thematic review, following RDR, relating to the full advice process. This starts with Initial Disclosure Documents (IDD), goes through fact finding, research, presentation, implementation and then review. The process should move smoothly through this process and will occasionally loop around as a review may mean making new arrangements. Throughout the process, the clients need to understand how and why various things will happen.

This starts with the IDD, which sets out the way the adviser intends the adviser/client relationship to develop. This outlines the terms of engagement, will cover the adviser status and range of services and the costs to the client.

Previously many advisers would make a sale and the closure would involve some kind of promise to come back to the clients to review with them. Due to the transactional basis of a lot of advice, the reviews were unattractive for the adviser because they were unlikely to generate further sales and could take up a lot of time. However, many of the more successful advisers saw reviews as the opportunity for more contact with the clients, that could unveil further needs or alternatively build the trust to obtain referrals to other potential clients.

There is plenty of anecdotal evidence that many clients had no reviews

However, this was all a bit hit or miss. There is plenty of anecdotal evidence that many clients had no reviews or even any further contact from the adviser after the initial sale. This was particularly detrimental over the years as various endowments fell behind targets, pension planning was not organised, life policies were no longer offering the correct cover, investments had under-performed etc. Any number of things were going wrong and not being picked up until too late. But all the while no reviews were being undertaken, the advisers seemed to be happy to pick up trail commission and renewals without actually doing anything.

Following on from RDR, the FCA was keen that many of the problems within financial services should be addressed and one of the best ways of doing this was to be more regimented about client reviews.

The IDD should now clarify whether the adviser will be offering reviews. If the adviser will be doing reviews, what will that review involve and how much will it cost. It may well be that the adviser has segmented their clients and will provide different levels of service.

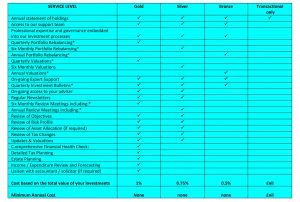

These levels of service may be as follows. It is important that the adviser outlines the services that they are actually willing and able to offer. The list below is likely to vary between advisers and firms.

As can be seen, the various levels come at a different cost as a percentage of the funds under management. In fact, the FCA would rather see monetary terms or fees relating to the time that the adviser will need to spend looking after the client.It may well be that the adviser may look to have a minimum charge in place, to ensure that the clients pay them something as retainer. The offer of the review will normally be formalised within the suitability letter. This will confirm the service level, the cost and also provide information regarding how the client can stop or opt out of the review service.

Review Dates

The FCA is keen that specific dates are offered for the review to take place. Also, the review must take place when it is due. If it is offered in September the review should not slip to October or later, without evidence that it was offered at the correct time and could not be completed.

Evidence

This is most important.Firstly, if the review does not place, there should be evidence that it was offered, but refused. This can be something as simple as a file note of a telephone conversation, or the copy of a letter or email to the client offering the review and possibly the response from the client. It is good practice for a firm to have a review document. This may be a fact find, or a shortened version as much of the information should already be known. The review form would be an aide memoire for points to be discussed. Or even an agenda. Points may be as follows.

- Current position – valuation of investments

- Changes in circumstances

- Changes in objectives/plans

- Review of Attitude To Risk

- Any changes in arrangements

These really are simply about catching up with the client. Bringing the adviser up to date about the client circumstances and bringing the client up to date with their plans and any changes to legislation or in markets.As far as reviewing attitude to risk, this is often covered by completing a new risk questionnaire. I may be a heretic in this respect, but I think that this is a waste of time. It is unlikely to produce a different result from the previous questionnaire. In my opinion, more value can be obtained by recording the opinions of the clients to various things that have occurred in the news or in the markets and how these have affected them.By recording all these items, it is then possible to provide ongoing advice to the clients. By keeping records of the reviews, it is possible to monitor the progress of the plans for the clients and to ensure that the clients financial planning objectives are achievable. This is evidence that the firm is Treating Customers Fairly.

I believe that this is what the FCA wants to see for all clients.