The organisation behind a pension dashboard (officially a Pension Dashboard Service firm or PDS) is usually considered to be a bank or insurer. The dashboard itself is conceived as a loss-leader designed to get trust – its a PR tool according to this article by the Pension Dashboard Programme’s , Richard James

For the organisations offering dashboards, the benefit comes from the relationship with the consumer. A bank or pension provider could extend the relationship they have already, or create one with new customers. A pensions dashboard could help them serve existing customers better by putting them more firmly in control of their finances. It also provides an opportunity to engage with people while they’re planning their retirement.

The three proto providers trialling the dashboard are Aviva, Bud and MoneyHub. Aviva needs no introduction and most readers of this blog will be familiar with MoneyHub who help individuals manage their money, were one of the first non-banking organisations to embrace open banking. Bud is not a consumer facing brand but an enabler -describing themselves on linked in as, “Helping enterprise-scale organisations to unlock the power of Open Banking and enriched transaction data to drive growth.”

No one should fight shy of looking at opportunities to recover costs and then deliver profits from an investment in becoming a dashboard provider.

What they have in common is industrial strength, these are organisations that the market considers are ahead of the curve on issues to do with data security and the probity of their business model. Rightly so, but does the Pension Dashboard need to be supplied at “enterprise scale” and does reputation count for everything?

I would expect Aviva , Bud and MoneyHub to have roles either as dashboard providers or dashboard enablers but I wonder if the organisations that apply for authorisation in 2023 and become ready for the Dashboard Available Point (we hope in 2024) will be “enterprises”.

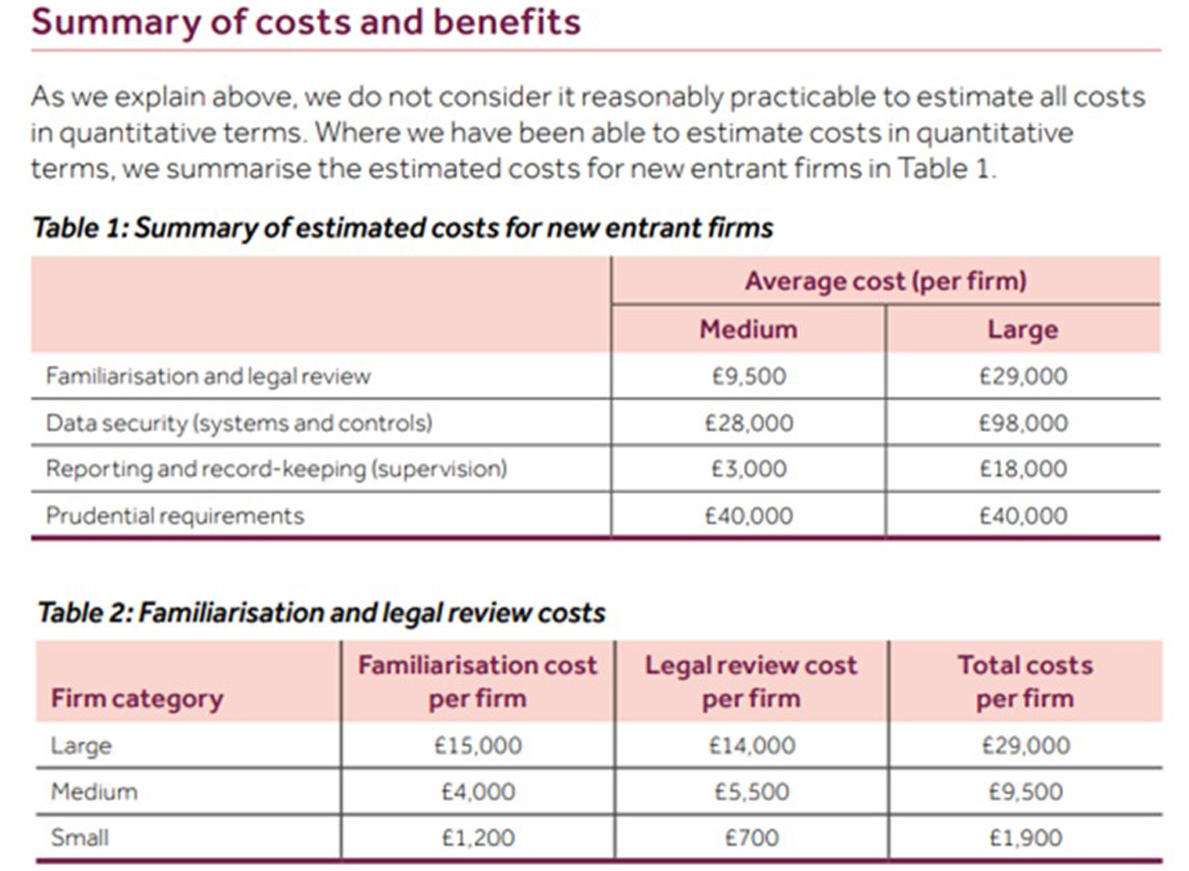

The barriers to entry , to provide a dashboard are surprisingly low. When you consider that the cost of applying to be a CDC scheme is £78,000, the £40,000 regulatory capital and £12,000 FCA fees to be a dashboard provider do not look prohibitive.

Proposed regulatory framework for pensions dashboard service firms – FCA

That FCA is even considering a “small” firm as a potential dashboard provider suggests that they do not see dashboards as prohibiting the SME and indeed the fin tech start-up.

What is more daunting for a small firm is the need for a full audit from Crest, this will mean that every aspect of the dashboard’s data management is tested for its capacity to withstand not just normal usage, but attacks from hostile hackers. The FCA are making it certain that any young firm looking to become a PDS must be “small but beautiful”. The standards laid down by both TPR and FCA and publicised through the Pension Dashboard Program are exhaustive.

The commerciality of the dashboard

The new word for sales is “origination” so I will use that word to describe what commercial opportunities there are for pension dashboard services.

Currently the cost of acquisition for SIPP, equity release, protection and annuity products is substantial, this is because originating products is hard where there is little pre-existing engagement.

The pension dashboard promises a moment – indeed up to 30 days when people can reasonably be considered in “buying mode” – ready to take action if there is an opportunity, if only to get the pension and related issues out of the way.

Own the customer’s attention for but a few minutes and the user experience should include doing something, if that something is no more than paying for a closer look at the decision’s ahead.

No one should fight shy of looking at opportunities to recover costs and then deliver profits from an investment in becoming a dashboard provider. In my views, pension dashboards need to stand on their own two feet to be sustainable.

Providing a service on a cross-subsidy from a bank or insurer or SIPP or master trust should not be considered a sustainable business plan either by investors or regulators.

I suspect that I will be arousing the ire of some of my colleagues in not-for-profit occupational pension schemes and I expect a sharp riposte from at least one member of the House of Lords, but I do see the fringes of dashboard becoming commercial market places and if not souks – certainly retail parks!

This does not mean that the core dashboard needs to be compromised, there is no need for data to lose its integrity or of confidence in the dashboard to be diluted. The pension dashboard’s core activities, finding pensions, collecting and publishing data and projecting forward, likely lifetime income – ALL WILL BE FREE.

Those for whom the advertisements of third-party services are distasteful will be free to watch the BBC of dashboards – MaPS. But commercial broadcasters have been a boon to the viewer and commercial dashboards will do the same for pensions.

So, if your organisation is potentially interested in becoming a dashboard provider, I’d encourage you to start familiarising yourself with the material already published on the dashboard provider hub. And to register your interest with the Pension Dashboard Program by emailing infopdp@maps.org.uk, so that you can be kept up to date as work progresses.

Dashboards need diversity. I am hoping that we will find a way to help people using pension dashboards make better decisions through the use of value for money as a metric, rather than price.