Imagine this customer: a 50 something Financial Adviser, based in Singapore but with an English wife who is living in the UK with your 4 children. His earnings last year were some £400,000 enabling him to work in Singapore, have the family schooled in the UK, with 2 properties in addition to a Singapore apartment. His family lives in one of the UK properties, and his current plans are to retire there once into his sixties. He is also something of a ‘cobbler whose children are poorly shod’: that is, pension arrangements are some way short of the UK LTA, although his Buy to Let in the UK will help retirement income once the mortgage on it is repaid.

Hardly vulnerable. Things could be worse.

They become so.

This customer’s position was at the start of 2020, then the pandemic arrived – even if initially well handled in parts of Asia.

Over the next 3 months his income collapses as the bonus, linked to investment returns in a crashing equity market, ceases. Earnings reduce to £200,000. One mortgage falls straight into arrears as the tenant in the BTL property ceases paying the rent. One of the problems of renting to the self-employed, non-furloughed. Having taken a 15-year mortgage of some £450,000 to buy the UK (family) home the repayments become unaffordable, and overdrafts appear.

shows that between March and October 2020, the number of adults with characteristics of vulnerability increased by 3.7 million to 27.7 million. A 15% increase on the February figure, this takes the overall proportion to 53% of all adults

What had been a high net worth looking financial position, slips into vulnerability. Not that this customer would meet most people’s definition of vulnerability – but it does meet the regulators definition.

Vulnerability is a relatively new term in the UK regulatory framework, having first been seen in the FCA’s ‘Vulnerability Exposed’ research in December 2014. The most recent guidance though comes in FG21 Guidance on Handling Vulnerable Customers published in February 2021.

The FCA vulnerability definition is “someone who, due to their personal circumstances, is especially susceptible to harm, particularly when a firm is not acting with appropriate levels of care.”

The FCA’s guidance also adds what I feel is a useful concept:

“Firms should think about vulnerability as a spectrum of risk. All customers are at risk of becoming vulnerable and this risk is increased by characteristics of vulnerability…”

Their first paper on Vulnerability (Vulnerability Exposed) states “While everybody can – and, indeed, most people do – experience vulnerability at some point in their lives, most of us, most of the time, do our best to ignore the possibility.” This highlights how widespread vulnerability may become, but more usefully then identifies the 4 key drivers which define the characteristics:

- Health–health conditions or illnesses that affect ability to carry out day-to-day tasks.

- Life events – life events such as bereavement, job loss or relationship breakdown.

- Resilience – low ability to withstand financial or emotional shocks

- Capability–low knowledge of financial matters or low confidence in managing money (financial capability). Low capability in other relevant areas such as literacy or digital skills.

These drivers work with the ‘spectrum of risk’ concept, which could apply in cases from all 4 drivers. Health conditions which impact day to day activities are not limited to physical impairments, and since March 2020 there have been numerous reports of increased mental well being shortfalls across the UK population*.

Life events too will be on a spectrum as the impact of – for example – divorce or bereavement will differ enormously depending on the circumstances and nature of each individual’s experience.

Resilience in this context is defined in financial terms, and the earlier case of the Singapore Financial Adviser would fall into this category.

Capability too lies on a spectrum, and although those of us in financial services would hope that we ‘know our customers’ and have communicated well, sometimes even well-informed customers may experience a reduction in capability, possibly doe to the impact of other drivers like a life event or ill health.

This highlights another facet of vulnerability, and the FCA’s words on spectrum: some customers will have multiple drivers. Vulnerability does not come limited to just one driver or characteristic.

How vulnerable are UK mortgage customers? While the straightest answer is ‘we don’t’ know’ the FCA Financial Lives Survey from earlier this year – “shows that between March and October 2020, the number of adults with characteristics of vulnerability increased by 3.7 million to 27.7 million. A 15% increase on the February figure, this takes the overall proportion to 53% of all adults.”

My reaction to the 53% figure was initially one of incredulity, although using the ‘spectrum of risk’ view, and the nature of the drivers during the pandemic, I was more understanding. Whether this extrapolates across the UK mortgage market is something which is currently being looked at by mortgage lenders across the country.

Where is the likely direction of travel in mortgage vulnerability? Despite the 53% figure above, numbers of vulnerable customers will depend on a set of drivers and constraints. The ‘drivers of the drivers’ include:

- Future interest rate rises, especially if passed straight through to those on variable rates.

- Changes in government policy, including further Covid restrictions, and possible reductions in assistance for self-employed. The effect of the removal of the £20 supplement for Universal Credit may have small effect too.

- The levels of unsecured debt: while we focus on the mortgage market, overall unsecured lending pressures remain.

Constraints on future vulnerability could include, the continued resilience of the property market. Even after the end of the Stamp Duty ‘holiday’, this should continue to give lenders some confidence that they will not have to face too much negative equity. The current jobs market also provides plenty of employment opportunities, although many of the jobs available are at the lower end of the pay scale.

What should mortgage providers do when faced with vulnerable customers? From my experience of working with banks and mortgage providers in the UK I suggest the following key themes:

- Financial services firms are frequently emphasising the importance of communication in correspondence and website advice, while the customer experience in communicating may reveal unhelpful approaches to vulnerability. While rigorous security standards must be maintained, factors like time taken to identify customers can add to stress a customer’s emotions. For example, they have to self-identify’ through call technology first, only to be asked exactly the same questions again by an agent a few minutes later. Budget planning questions and questionnaires are not universal, putting pressure on customers to have facts and figures, possibly in a different order to another institution – say another lender – if they have multiple financial issues to handle. Remember the FCA’s guidance about ‘appropriate levels of care’.

- Most mortgage providers have experienced call handlers for dealing with mortgage arrears and vulnerable customers, and the importance of voice tone has been highlighted in research from Bristol University*

Options. Lending policy may need to be flexible enough to cope with changing situations. For example, going back to the financial adviser mentioned earlier, one issue affecting the lender was the age limit on the original mortgage agreement, which sought complete payment by age 65. Other lenders may have limits on terms, age, or use of “Interest only” for a while. The more options you are able to access, the greater flexibility you can share with the customer.

Remember that these themes will need to reflect this element of the FCA’s Guidance:-

“to achieve good outcomes for vulnerable customers, firms should:

- understand the needs of their target market / customer base

- ensure their staff have the right skills and capability to recognise and respond to the needs of vulnerable customers

- respond to customer needs throughout product design, flexible customer service, provision, and communications

- monitor and assess whether they are meeting and responding to the needs of customers with characteristics of vulnerability, and make improvements where this is not happening”

Repossessions – traditionally the ‘last resort’ of the mortgage lender – have shown a marked decline in recent years, and during the pandemic the government prevented them altogether. But repossession may be a step unlikely to be acceptable when seen alongside deeper vulnerability, especially if the driver is health or life event over which the borrower has less control.

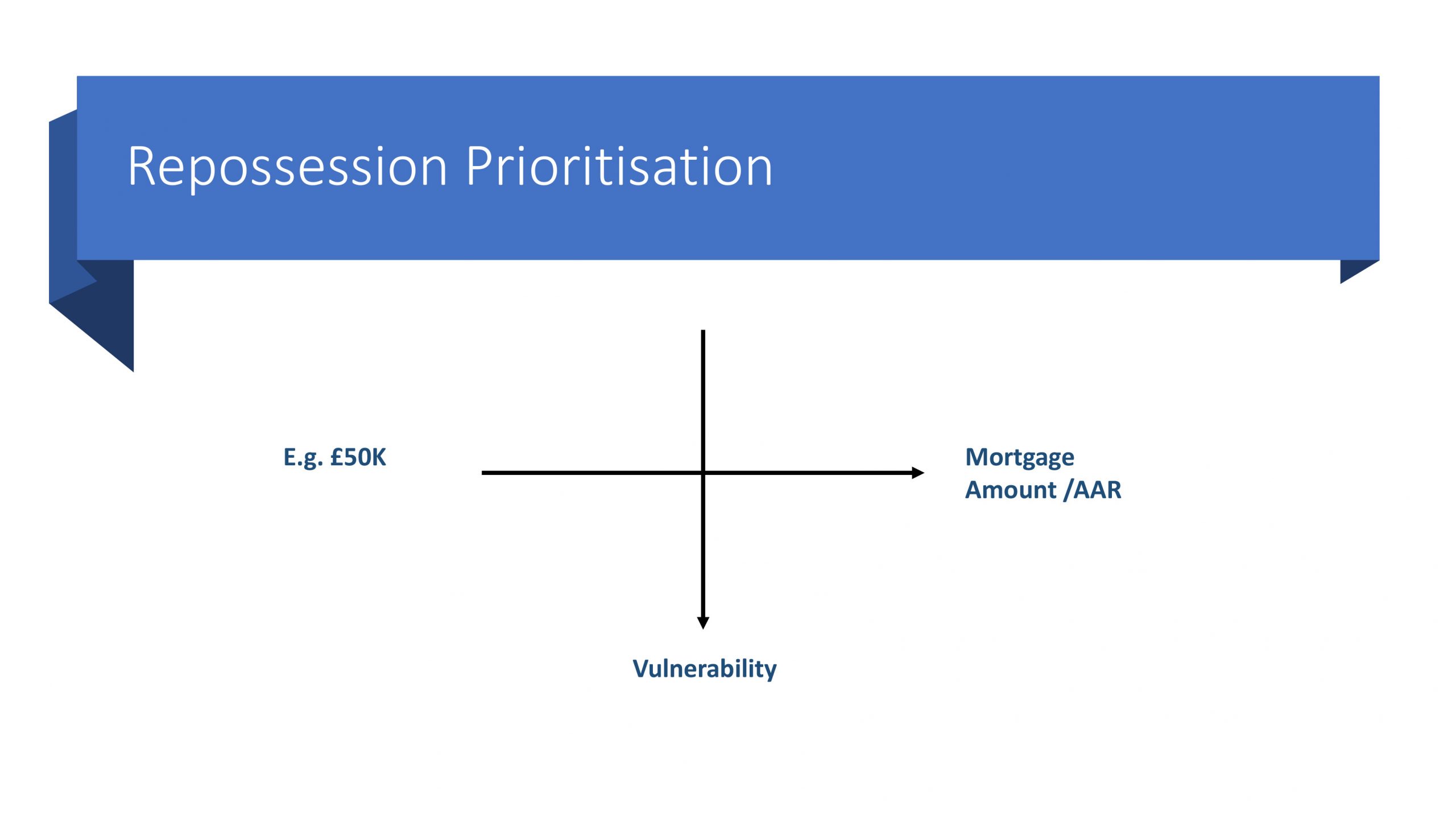

Mortgage lending will always feature the management of repayment issues, and when discussing this with lenders I have come across a range of approaches but summarise these in a model which balances vulnerability with amounts at risk. This combines 2 spectra, and while it involves data this remains a subjective, judgemental approach.

Firstly amount at risk: each institution can customise its approach here. For some, depending on the lending book, numbers and amounts of arrears, they may start with an amount which would typify a small amount of arrears. The starting amount therefore is unlikely to be zero and will be affected by the number of customers with problems.

Then add the spectrum of vulnerability. There could be various iterations, but I suggest those with just one ‘driver’ be categorised lower than those with multiple drivers. Secondly, each driver could also have a weighting applied to it, depending upon the assessment made during customer calls.

If problem mortgage accounts are plotted using this tool, the pattern for action becomes relatively easy to see – you start with those in the top right-hand corner, with different actions and approaches than for those in the bottom right. Then go top left followed by bottom left. Briefly, prioritisation goes diagonally across the matrix from right to left. What this tool should do is enable a view to be taken about what additional action should happen to help protect the lenders position, but also to protect vulnerable customers.

In summary, I suggest every lender in the UK will have vulnerable customers, some more obviously than others. The way these customers’ issues are handled will have an important impact on customers’ lives, and also an important impression of the lending institution, and it’s claimed values.

https://www.fca.org.uk/publication/research/vulnerability-exposed-research.pdf

https://www.fca.org.uk/publication/finalised-guidance/fg21-1.pdf

https://www.fca.org.uk/publication/feedback/fs21-6.pdf

* A key lesson here is the tone in which lenders communicate early messages and warnings about mortgage arrears (whether in writing or verbally) – In essence, this involves getting the balance right between conveying the seriousness of the situation while making it clear that there are steps that the mortgagor can take to sort things out, all the while showing an understanding of the fears and anxieties that mortgagors may have. “ https://www.bristol.ac.uk/media-library/sites/geography/pfrc/pfrc1709_customer-perspectives-on-mortgage-arrears.pdf