I have recently embarked on research into ESG Investment and am due to complete my report on this by the end of October. It has introduced me to a whole new world of Responsible Investment and there are advisers who have been operating in this space for years and have built up considerable expertise. This has been great as they have been very helpful to a newbie dabbler like me.

The FCA brought in the Sustainable Finance Directive earlier this year. This is making it mandatory for fund managers and institutions to be very clear about how their products comply with EU rules and MIFID in transparency and clarity regarding their investment culture. Currently, this only refers to those institutions, but the expectation is that soon advisers will be drawn into this regime and need to be able to prove that they have offered clients sustainable finance products.

Personally, I think that Sustainable Finance is very easy for advisers to introduce to clients as the issues are so topical and increasingly in the news. Indeed, people would almost have to be avoiding any news media to be unaware. Certainly, I think that this is a far easier conversation than attitude to risk. It is dealing with issues that directly affect people on a daily basis without needing to resort to abstract ideas.

Talking about it is the easy, bit, but advising clients about products and funds could become quite daunting for advisers.

Talking about it is the easy, bit, but advising clients about products and funds could become quite daunting for advisers.

Firstly, there is the fact finding relating to responsible investments. I have seen several different fact finds which collect this information by way of tick-box questionnaires. A whole set of issues relating to positive and negative criteria. This is useful for filtering, but it has its drawbacks. If someone has ticked that all of the criteria are important. Then the choice of funds available can be quite limited, if there are any funds left at all that are totally suitable to match the client’s choices.

The advisers need to be very careful to manage the client’s expectations and to record the choices made and advised.

The choice of fund manager and fund are going to be very important. To truly work for the client having made a menu of demands, the chances are that the investment will need to be bespoke rather than a managed portfolio. Due to the costs of this, truly Responsible Investment may not be economical for the client’s if the investment funds are not high enough value.

Compromise may be required in order to meet the client’s demands. Possibly rather than ruling out certain classes of investment e.g. Pharmaceutical companies, the fund managers may need to use a “best of breed” approach to enable their funds to include those types of company. In the case of energy companies, the choice may well be based on how far a company is transitioning from traditional fossil-based fuels to renewable energy. These judgement calls by the fund managers can be quite subjective as empirical data may not be available to prove investee company claims about their green credentials.

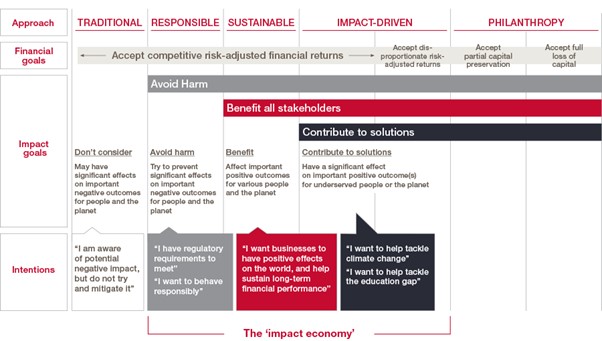

If you consider the application of the ESG Investment spectrum, it may well be this that will become more important for advisers to consider than attitude to investment risk

Looking at this, most retail clients are unable to consider the philanthropy end of the spectrum as they are likely to be investing for financial gain.

As we go forward, investment is likely to gradually switch away from the traditional end of the spectrum as very few clients will say that their goal is heel for leather pursuit of profit and growth with no consideration of the planet and their fellow human beings.

So, I believe that fund managers will need to be quite clear where their investment strategy and culture sits within this spectrum. Having discussed this with several fund managers, they are likely to have fund offerings that straddle all of the investment strategies.

Like SM&CR, firms are being encouraged to develop a culture of good behaviour, fund managers are being encouraged to make Responsible Investment an integral part of their culture, rather than being a “nice to have” added extra.

There is the suspicion that fund managers who have introduced an ESG based investment fund to be part of the current investment fashion may be guilty of “greenwashing”. This is producing a fund that claims to have ESG credentials based on a lot of “best of breed” choices and early-stage transitional companies rather than embracing a responsible investment culture.

All of this requires due diligence to be carried out by advisers. Both at the outset, when making the investment and ongoing to ensure that the investments maintain their “responsible” status. Advisers will be almost entirely reliant on fund managers in this respect as most advisers are unlikely to have the resources to devote to the level of due diligence that would be required to do the job properly.

Sustainable finance is the way investment advice will be delivered in the future. As the world is trying to move towards zero carbon, minimising global warming and generally keeping mankind alive, anybody not embracing this culture will be left behind like the dinosaurs. Therefore, any thoughts about sustainable finance-based funds offering limited returns should be dismissed. It will be the traditional funds that will fall behind as more investments are moved to ESG based funds. Companies that are not transitioning quickly enough, may find their perceived value diminishing quite dramatically in the future.

I think that this is the direction of travel.