Chartered Insurance Institute product marketing manager Tom Cox looks at the changing face of the Institute’s financial services qualification framework and introduces the new Certificate in Financial Services

In the build up to the retail distribution review (RDR), financial advice became the obvious focus for Chartered Insurance Institute (CII) qualification developments. Sweeping changes in the regulator’s requirements called for responsive and robust enhancements to the CII’s offering. A new suite of R0 units designed around advisers’ new exam standards was swiftly followed by other adviser-specific options; a new wrap and platform services unit was introduced, so too were qualifications covering securities advice and dealing and discretionary investment management.

With the RDR dust now somewhat settled, CII qualification framework development has entered a new phase – one that places a renewed emphasis on supporting those who support and sustain the provision of financial advice and help deliver and administer retail investment products. After all, more than 30% of Personal Finance Society (PFS) members are not advisers. And while adviser-specific learning can be of value to anyone involved in the provision of an advice service, the varied and sometimes role-specific development needs of the industry as a whole cannot be ignored.

the varied and sometimes role-specific development needs of the industry as a whole cannot be ignored.

The CII now offers a dedicated qualification route for paraplanners, or would-be paraplanners, for example. The Certificate in Paraplanning is the first CII financial services qualification to include coursework assessment, a move that recognises the specialist report-writing expertise needed to deliver sound professional advice. Taking another example, the Certificate in Investment Operations, launched last year, offers three qualification routes for those involved in the operational administration of investment products.

Certificate in Financial Services

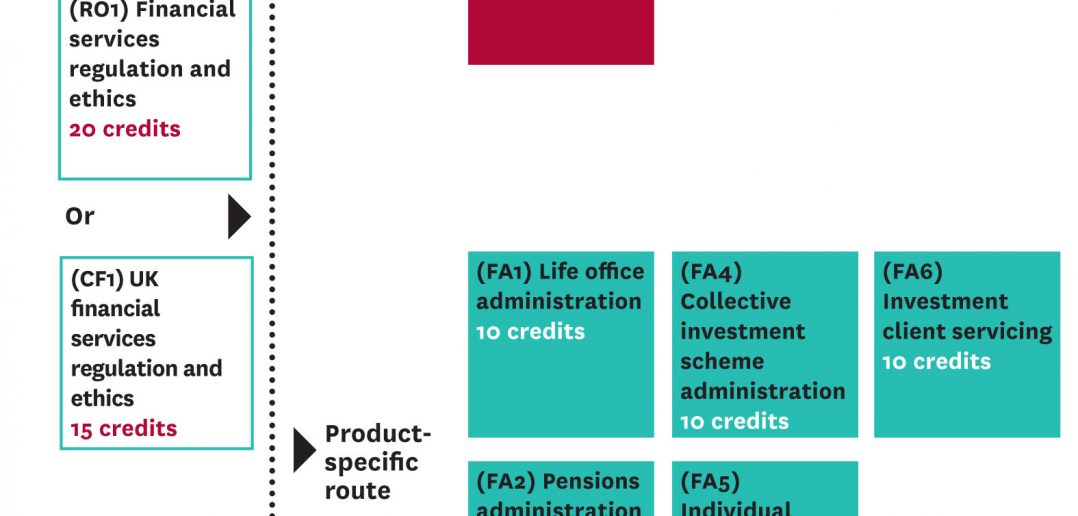

The latest addition to the CII’s range of non-advice qualification routes is the Certificate in Financial Services – a QCF Level 3 qualification developed to meet the needs of those working in operational and technical support roles in financial advice and financial services.

The Certificate offers a choice of learning pathways to suit a range of circumstances. It utilises existing units as well as the new unit, (FA7) Financial services products, which covers the fundamental aspects of customer service, administration and marketing in financial services, and key retail investment products including savings, investments and tax wrappers.

FA7 key facts

| Study hours | 100 |

| Assessment method | Two-hour online exam; 75 multiple choice questions |

| CII credits & level | 20 – Certificate |

The Certificate in Financial Services is awarded upon completion of one of two routes, and PFS or CII members who complete the Certificate can use the designation Cert CII (FS).

General route

This two-unit route is ideal for those providing operational support to financial planners, including paraplanners and technical support staff working in financial services. It develops knowledge and understanding of:

- The financial services industry in general, including regulation and legislation;

- Fundamental aspects of customer service, administration and marketing in financial services, and key retail investment products including savings, investments and tax wrappers.

Product-specific route

This route offers an ideal next step for holders of the Award in Financial Administration or Certificate in Investment Operations, involving the completion of one further unit. It is particularly suited to those

involved in, or overseeing, the operational delivery of life, pensions or investment products, and those in other financial services support roles. It develops knowledge and understanding of:

- The financial services industry in general, including regulation and legislation;

- Overseeing and administrating financial products, giving a choice of two from five units: life office administration; pensions administration; collective investment scheme administration; individual savings account administration; and investment client servicing.

You can find full details on the Certificate in Financial Services online at: www.cii.co.uk/cert-financialservices

Certificate in Financial Planning withdrawal

Introduced in 2006, the Certificate in Financial Planning was developed as a Financial Conduct Authority ‘appropriate qualification’ for financial advisers. Since the minimum qualification level was raised from QCF Level 3 to Level 4, Certificate in Financial Planning enrolments and exam entries have naturally declined.

Current enrolments are now limited to a small number of individuals working in support or ancillary roles, seeking to gain a grounding in financial services and financial advice. With Certificate in Financial Planning units CF2, CF4 and CF5 having effectively been replaced by Diploma-level units and not being part of the new Certificate in Financial Services, these are now being withdrawn.

Exam withdrawal

Units CF2, CF4 will be examined for the final time in August 2015 and CF5 in July 2015. Prior to their withdrawal, units CF2 and CF4 will be available to sit year-round, typically weekly, and unit CF5 will be available to sit in April and July 2015. For more information and FAQs visit www.cii.co.uk/cert-financialplanning

Use of the Certificate towards other qualifications

Diploma in Financial Planning

To-date, holding the Certificate in Financial Planning was required in order to complete the Diploma in Financial Planning. Because of its planned withdrawal, the new Certificate in Financial Services now also satisfies this requirement.

Advanced Diploma in Financial Planning

To complete the Advanced Diploma in Financial Planning candidates previously needed to hold the Certificate in Financial Planning or Diploma in Regulated Financial Planning. This has now changed to either the Diploma in Financial Planning or the Diploma in Regulated Financial Planning.

FAQs

Here are the answers to some of our most frequently asked questions on the introduction of the Certificate in Financial Services and withdrawal of the Certificate in Financial Planning.

1. I already hold unit CF1 and two ‘FA’ units, will I be awarded the Certificate in Financial Services?

Yes. Anyone satisfying the completion criteria for the Certificate in Financial Services will be awarded the qualification. Those who satisfy this criteria because of past exam passes will be sent written confirmation of their completion, together with a completion certificate, during the first week in June. Details will also appear on their learning statement.

2. I am part way towards completing the Certificate in Financial Planning and am unsure whether I will complete before it is withdrawn. Can I switch to the new Certificate in Financial Services?

Final exams are scheduled for July and August 2015 in order to allow sufficient time for existing enrolees to complete their studies. Candidates do, however, have the option to switch to the Certificate in Financial Services if they feel it better suits their learning needs.

3. Once the Certificate in Financial Planning is withdrawn, will CertPFS members still be able to use the designation?

Yes. Although the qualification that awards the CertPFS designation is being withdrawn, existing qualified members will continue to be able to use the designation.

4. Does the new unit (FA7) Financial Services Products count towards any other qualifications in the financial services framework?

Yes. Subject to completion rules, unit (FA7) Financial Services Products provides 20 Certificate-level credits towards completion of the Diploma and Advanced Diploma in Financial Planning and the Certificate in Life and Pensions.