‘….if culture is left to its own devices, it shapes itself with the inherent risk that behaviours might not be those desired..’

The start of the New Year is traditionally a time to review what we do, and how we do it. And let’s face it, it feels as if change continues with almost unabated pace. The past year has seen RDR, a new Regulator and the Mortgage Market Review is approaching fast. Many things are changing but the reality is that the fundamentals of business remain the same. In the regulatory world there are, as always, two key business drivers:

- Ensuring that FCA rules and principles are clearly met and demonstrated, and

- Enabling businesses to make a satisfactory return to their owners and investors.

Many would argue that these are contradictory objectives and never the twain shall they meet. I don’t subscribe to this view. Making money and placing the interests of clients at the focus of what we do is not only doable, but an imperative. But I do accept that in order to achieve this at a time when compliance costs are generally rising means that we have to get better at what we do. This is where, I believe, having an effective T&C culture is important.

There are two certainties with culture. First, you can’t avoid having a culture. Your firm will have a culture as will key business practices – which include T&C. Secondly, it’s difficult to assess and change something if you aren’t sure what it is. Granted, culture is not visible; it is intangible and is difficult to define. But as we all know, it is also usually very clear when it works for the business and when it doesn’t. So perhaps the important bit if you want to manage culture is first to make it visible.

So perhaps the important bit if you want to manage culture is first to make it visible.

T&C Culture

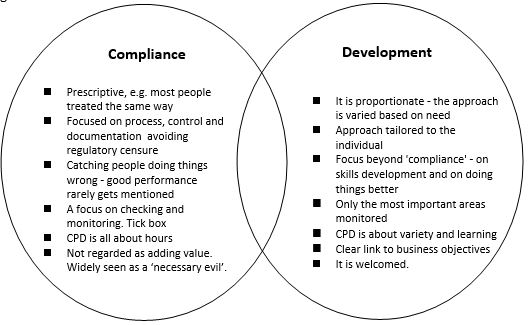

How is T&C viewed within your business? When it’s time for an observation with an adviser, do they look forward to it? Is T&C primarily seen by staff as compliance, monitoring and managing risk, or about developing people and improving performance? Of course, they are never going to be exclusively one and not the other but that’s not really the point – culture will be based by how it is perceived overall. A quick test is to see overall which of the following characteristics are most recognisable in your firm.

| Development |

| It is proportionate – the approach is varied based on need Approach tailored to the individual Focus beyond ‘compliance’ – on skills development and on doing things better Only the most important areas monitored CPD is about variety and learning Clear link to business objectives It is welcomed. |

| Compliance |

| Prescriptive, e.g. most people treated the same way Focused on process, control and documentation avoiding regulatory censure Catching people doing things wrong – good performance rarely gets mentioned A focus on checking and monitoring. Tick box CPD is all about hours Not regarded as adding value. Widely seen as a ‘necessary evil’. |

Concerns were of course, expressed by the FSA about whether firms generally have the right balance. Most notably in June 2010, a consultative paper2 said ‘we are concerned that there is insufficient focus on coaching and too much focus on monitoring’ and ‘for the avoidance of doubt, a file check is not supervision’. There is a simple way of testing this out in your business – just ask staff how much they feel T&C helps them to do their job better? That should give you the answer to whether you have a predominantly compliance culture or a development culture.

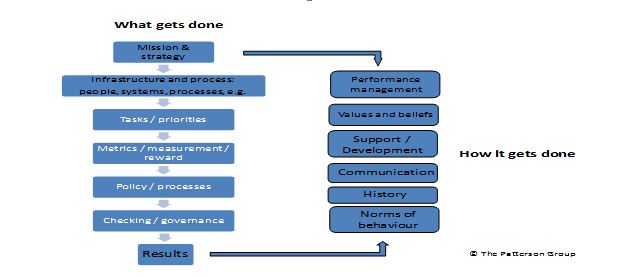

So if your culture needs to change, what do you do about it? My preferred approach is to look at culture as a blend of what a business does, and how they do it which is shown in Figure 2. Ultimately it is the DNA for your business. The important thing is to focus on the key elements that make your culture unique. Once you have this, you then have the ability to take steps to positively influence and change it.

Figure 2 – The elements of culture

10 point action plan to develop a positive T&C culture.

It isn’t possible to fully explore each of these areas from Figure 2 in this article so here are some key thoughts.

- Are people clear about the future direction and what the business needs from them both now and in the future? This is as much about making a clear link between development and what the business needs as it is identifying potential skills gaps. Of course, active senior management oversight and engagement with T&C also contributes to the culture.

- These include your T&C documentation such as the observation aid. Do these reflect the real word post-RDR? In firms where T&C is about development, as much emphasis is given to the behaviours the adviser demonstrates as they give to the regulatory driven mandatory areas.

- Results / reward. You get what you reward so make sure remuneration and incentives are aligned to your clients interests using both quantative as well as qualative measures.

- Measurement of performance. One aspect of this are the key performance indicators (KPIs) that firms use. If these don’t reflect what is important and aren’t accurate, what does this say about T&C in your firm? More than ever post-RDR, we should be looking at areas such as client satisfaction measurement, delivering on service level standards and meeting income

Here’s a radical thought. If we really do put our clients first, perhaps our observation form should also do so. Does it focus on the client and their understanding, or the process followed by the adviser? For example, a standard on an observation form might say ‘client demonstrates their understanding of the services provided’ instead of ‘adviser explains SCDD’. This is a significant shift of focus – after all, how would you know the client understood? That’s great because it can only be observed if the adviser establishes this.

- Values and beliefs. How much do people take personal responsibility? Do they drive their own CPD and development or expect it to be done for them? What does your business stand for: excellence, added value, going the extra mile, honesty and genuinely putting the client first, or we can’t afford it, do what you can and only tell people what they need to know…?

- Being an adviser can be a lonely place. T&C supervision can be a way of ensuring a consistency of approach but it should also be about sharing best practice between advisers and further developing everyone’s skills.

- Support / development. Do it! Where ever possible, catch people doing things right. Accept that making mistakes is an inevitable part of learning and trying to do things differently so respond accordingly. Set positive expectations that everyone should find ways things can be done better.

- This shapes how people do things ‘because that’s what was done to me…or… how it’s always been done’. People will generally do what they feel is in their best interests so do what is right and adds value, not because it’s what has always been done in the past.

- Norms of behaviour. Is T&C risk-based so that everyone isn’t treated the same way? Is T&C business as usual or is there a culture of having a ‘T&C day’? The later can be particularly corrosive as it suggests it’s something to be ticked-off the list before returning back to the more important stuff.

- Checking / governance. With checking, make it light touch, risk-based and effective. With governance, people need to see that senior management feel this is important. The positives of having a senior manager who is engaged and visibly supportive of T&C is only surpassed by the negative impact of one that isn’t.

Both the FSA and now the FCA have talked with increasing frequency about the need to have an effective culture that supports the business model and practices within a regulated firm. Getting it right presents the prospect of not only having a firm with a lower risk profile, but the dividend of a more profitable and enlightened business. A year on from RDR, perhaps now is a good time to ensure that T&C plays it part in achieving this.