Unless you have been out of the country for a while, you can’t have failed to notice the plethora of Consultation and Guidance papers emitting from Canary Wharf which make reference to conduct, culture, behaviours, accountability and so on. But what does it all mean to someone who is responsible for training and competence in a firm?

In my last article I talked about the importance of alignment and why T&C Schemes and particularly competencies and T&C KPIs are vital to the successful achievement of commercial success, great customer outcomes and regulatory compliance. I would like to continue with that theme and focus on the relevance and importance of ethics, values and behaviours to T&C outcomes in any firm, something that’s not new.

“TC success is almost always a direct reflection of the firm’s culture and the priority given to professionalism by the most senior staff. (FSA CP10/12 June 2010).

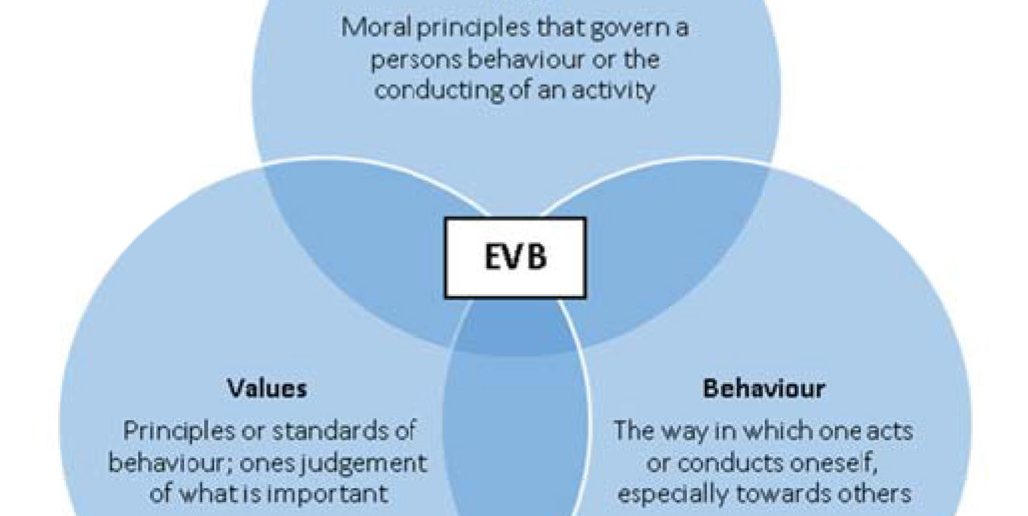

Ethics, values and behaviours are often used in the same sentence but what do they actually mean and are they really “soft risks” as some have described them?

Figure 1: The link between ethics, values and behaviours

It is clear that they are in fact inextricably linked and are mutually dependant on each other. They will manifest themselves in individuals and also collectively in firms. Therein lies the issue, unless a firm has been really clear

about what ethics, values and behaviours (EVB) means in that firm and what good looks like for them, individuals may not be aligned and it is this misalignment or non-adherence that can cause harm to the firm, its customers and also the market…..in other words, misconduct. This is not a soft risk.

Many firms have taken action to address ethical standards but how often do they really come to life and are they ever seriously and consistently tracked and measured in relation to the impact on the business and its customers?

“….the right culture is essential for achieving good conduct performance. This is not though a fluffy view of vague corporate aspirations or value statements ….” (Director of Supervision FCA, March 2014).

I believe that this is where a good T&C framework comes in and not just for advisers and supervisors either. For example, SMR, SIMR and the proposed Certified Regimes make it abundantly clear that EVB needs to be part of a firm’s culture and conduct…top down.

It is not necessarily easy but I believe that it is simply non-negotiable if a firm, and the people within it, is to achieve sustainable success in all respects.

My argument that thinking differently about your T&C KPI’s and bringing Ethical Behaviour competencies into play has never been more relevant. It is not necessarily easy but I believe that it is simply non-negotiable if a firm, and the people within it, is to achieve sustainable success in all respects.

So, how can you bring EVB to life and help it become firmly established through T&C arrangements where it can deliver value for; you, your firm, your customers and the market? Here are some ideas that may help.

Defining What Good Looks Like

Reflect on your current T&C Competence and KPI sets. Ensure they provide clarity about the EVB needed to achieve objectives, customer outcomes and regulatory compliance – making the connection between EVB and the achievement of objectives much tighter.

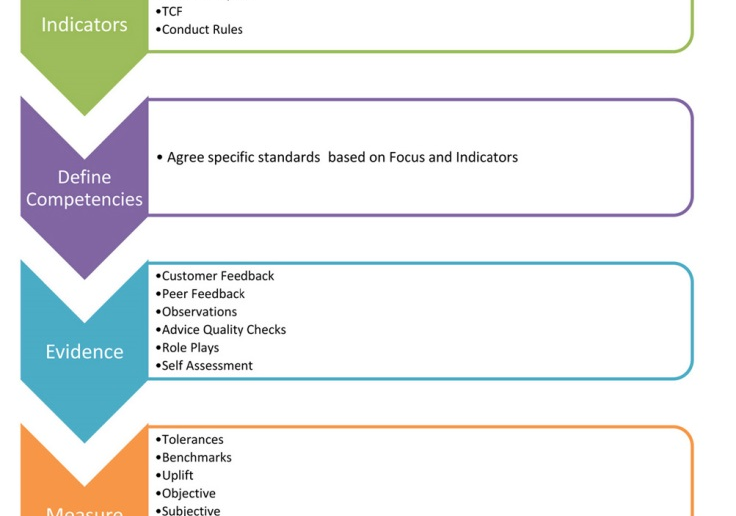

- Clearly define the standards in your firm for all roles. I recommend that you work through the steps set out in Figure 2 in conjunction with key business stakeholders as a way of ensuring that the standards are owned, appropriate, relevant and actually achievable.

Figure 2: Defining EVB standards in your organisation – the logical steps

You should end up with a number of competencies under the Ethical Behaviour heading with clear definition, measures and sources of evidence. Ideally these will sit in your T&C system where they can be managed and presented as meaningful intelligence and MI to all stakeholders in your firm.

- Advice and business processes are often described as physical steps rather than in terms of outcomes. Determine EVB standards by putting your firm in the customers shoes, this will lead to the EVB elements that are most important and which can then be translated into measurable outcomes in your advice, sales or service process.

Training

- Consider how your recruitment and induction programme could help new entrants fully understand; what is expected of them in terms of EVB, their responsibility to the regulator and their Accredited or Professional Body, how the T&C framework will routinely focus on this and the part they will play in assessing and evidencing their own performance against these measures.

- Focus on how EVB is central to the advice or business process the new entrant will be involved in. This should also be assessed and evidenced through role play and case studies for example.

- Deliver training for managers, supervisors and assessors on EVB standards – how to identify, assess, measure, coach and apply judgement through the use of management or supervision tools developed to support this.

Prerequisites for progress within a T&C framework

- Evidence of competence in and adherence to EVB should form part of the criteria for approval and sign off through the various stages of the lifecycle and role e.g. from close supervision to achievement of competence.

- If there is insufficient evidence or proof of these, an individual can surely not be deemed “competent”.

Embedding

- Successful embedding needs to be supported and encouraged by the right management tools; oversight, performance reviews, observations and quality assurance checks to name a few. Consider how these can be enhanced with the creation of agendas, standards and scoring mechanisms that include EVB.

- CPD is now firmly rooted in day to day activity, however it can often be very knowledge focused. By linking CPD to behavioural standards, you then make it possible to place greater emphasis on development that will support EVB. This may involve creating appropriate learning material internally or pointing staff towards sources externally.

- Supervision planning should tackle how managers and supervisors will support individuals through honest performance discussions, observation, coaching and feedback etc.

Measuring

EVB competencies are more difficult to hardwire into specific data sources unlike KPI’s like persistency and complaints. Therefore we need to consider what information and intelligence would inform these measures as there are likely to be many influences to be considered before arriving at a conclusion about competence or non-competence in EVB. There may need to be more emphasis on and comfort around application of judgement and that can be assisted by the following:

- Honest performance discussions with managers

- 360° feedback

- Self-assessment

- Customer feedback and mystery shopping

- Moderation of results across teams and firms

- Advice or service quality assurance

- Spotting ethical flexibility – compromising ethical standards in the interests of career progression or other pressures

MI & Reporting

- If you have structured your competence and KPI sets as described above, you will be able to see how individuals, teams and your business are performing in terms of EVB.

- Think about MI and intelligence in terms of key questions you and your firm need answers to. So for example: Are our people behaving ethically? Can we present a compelling story about the strength of our conduct, culture and professionalism to our customers, the regulator and our own people?

- Reporting needs to be acted upon in terms of positive reinforcement or remedial action.

Taking Annual Declarations of Competence seriously

As this is a responsibility for the firm and the individual, this has to be more than a tick box process. It is a serious aspect of your T&C framework where ownership, responsibility and accountability can be tested.

- Collect evidence that will allow an individual to confirm that they have complied with APER or a code of conduct in the preceding 12 months. There must be appropriate evidence to back up their declaration.

- Vet the accuracy of the response and declaration.

- This can also be applied to any role so that individuals know what their responsibilities are.

Whistle Blowing and calling it out

This is arguably a logical step in developing the right culture of accountability and shared ownership. To create a culture and business environment where poor EVB or misalignment is surfaced through appropriate whistleblowing procedures or being called out when it is witnessed or experienced by colleagues.

“….acting with integrity; professionalism; paying regard to the interests of consumers; treating them fairly; and being open and co-operative with regulators.……..principles that provide a clear baseline for all staff. And should support key areas like performance management, career progression and the like, as well as giving staff greater confidence to challenge colleagues if basic principles are abused”. (Speech by Martin Wheatley, Chief Executive of the FCA, 28 May 2015)

Performance Management and Reward

The culture of a firm is important in ensuring customers are at the heart of how a business is run. A key driver of culture is how people are rewarded and the behaviours that are valued and recognised by the firm. (GC 15/1 FCA March 2015)

- Make strategy, objective setting, competencies and EVG seamless and then relate these to the reward scheme. This makes the firms T&C framework a pivotal part of the organisational structure and a “can’t do without” aspect of successful performance management and decision making.

Conclusion

Someone once said that you must “inspect what you expect”. As ethics, values and behaviours are so critical, they must be a central feature of T&C and good people performance management. If EVB hasn’t been defined it can’t be embedded, tracked, managed and measured. That is where it can all start to go wrong and result in misalignment.

There are pointers for all financial services sectors in the accountability regimes and conduct rules proposed for banks and also in guidance issued by the FCA on Performance Management. As we move more towards the Presumption of Responsibility or “burden of proof” sitting with the firm and individuals, the importance of being able to demonstrate the impact of excellence in EVB on your firm, your employees and particularly on your customers cannot be overlooked.