This is the time of year, when clients invariably ask how much can I pay into my pension? This has become an increasingly difficult problem, due to the changes in legislation in respect of tapering of the annual allowance.

The following article examines some of the issues surrounding contributions and highlights the information required to enable an accurate calculation to take place.

The first point to establish, is whether the client has previously accessed any benefits and thereby, triggered the money purchase annual allowance (MPAA). A list of the trigger events can be found at the following link

https://www.gov.uk/hmrc-internal-manuals/pensions-tax-manual/ptm056520

It may be prudent to write to clients on an annual basis, at the start of the year, outlining the issues of MPAA. A client receiving a letter from a provider confirming that they have a policy that can be accessed, may think of this as a windfall. However, it will have serious consequences for the adviser and the client if the MPAA is triggered.

However, it will have serious consequences for the adviser and the client if the MPAA is triggered.

The significance of checking the position regarding the trigger events is highlighted In a FOS ruling in 2020, where an IFA allowed an employer contribution to be made and did not obtain confirmation whether the client had accessed benefits previously. Carry forward is not available if a client has triggered the MPAA.

https://www.gov.uk/hmrc-internal-manuals/pensions-tax-manual/ptm146600

This mistake cost the IFA practice some £60,000. Another point to note here, is that it is not possible to have a refund of employer contributions for merely exceeding the available annual allowance.

Inheriting new clients that have previously paid single contributions or have used carry forward will require good data collection.

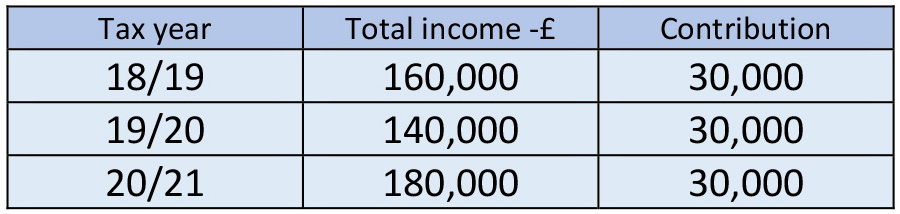

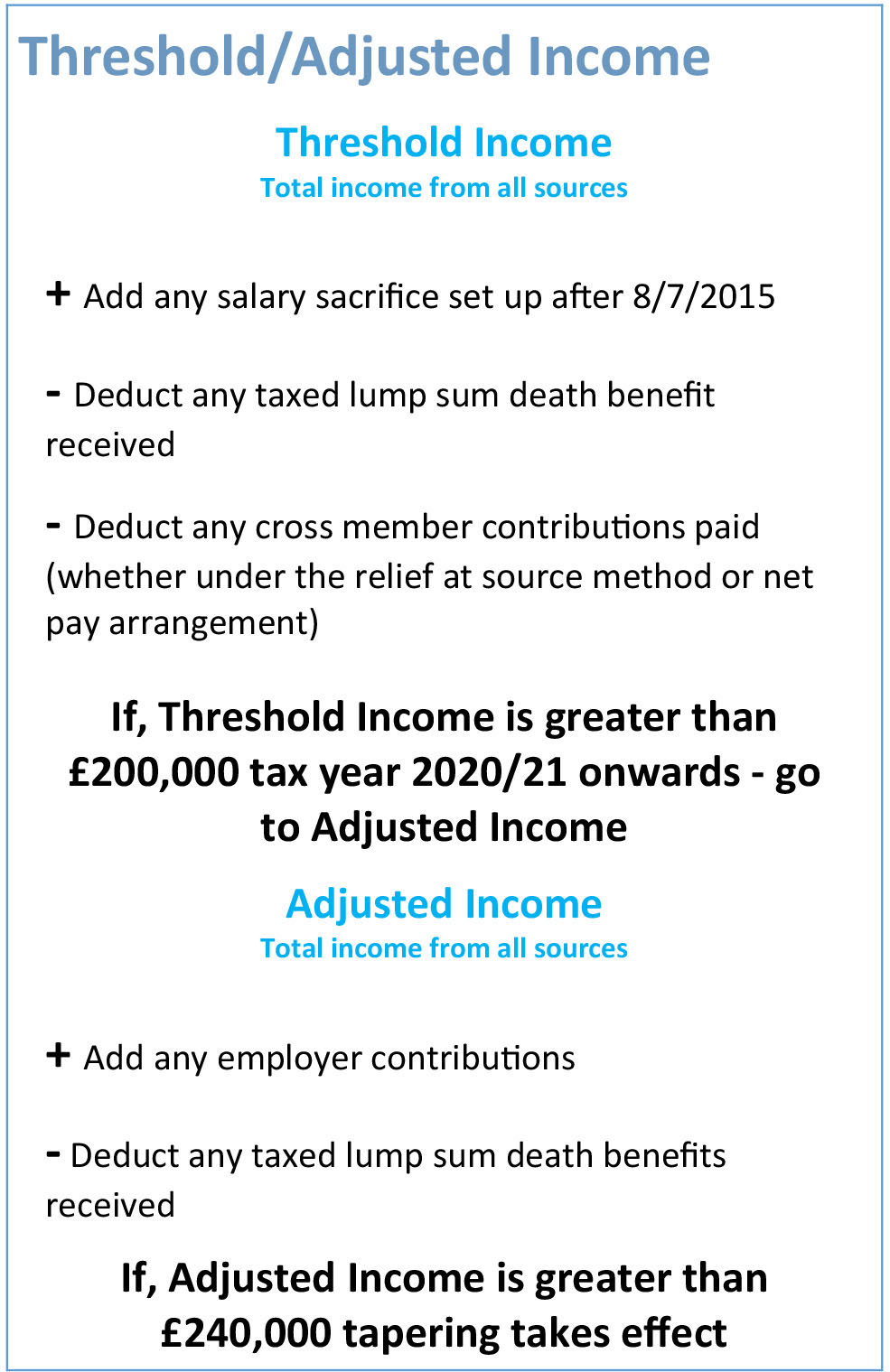

Although threshold and adjusted income have increased with effect from the 20/21 tax year £200,000 and £240,000 respectively, the lower threshold and adjusted income are relevant for the 18/19 and 19/20 tax year. In addition, the need to have accurate records in respect of the contributions is extremely important as the following example will demonstrate:

From the above, we do not have sufficient accurate information to proceed with the calculation for the current year. If, the above contributions were personal, then the carry forward position is as follows:

18/19– £5,000

19/20–£10,000

20/21–£10,000

In the example above, if the contribution had been paid by the employer, then the carry forward position is different.

18/19 – (£10,000)

19/20 – Nil

20/21 – £10,000

So, in this case, it would be prudent to ensure that the client had carry forward available prior to 18/19 to mitigate the excess.

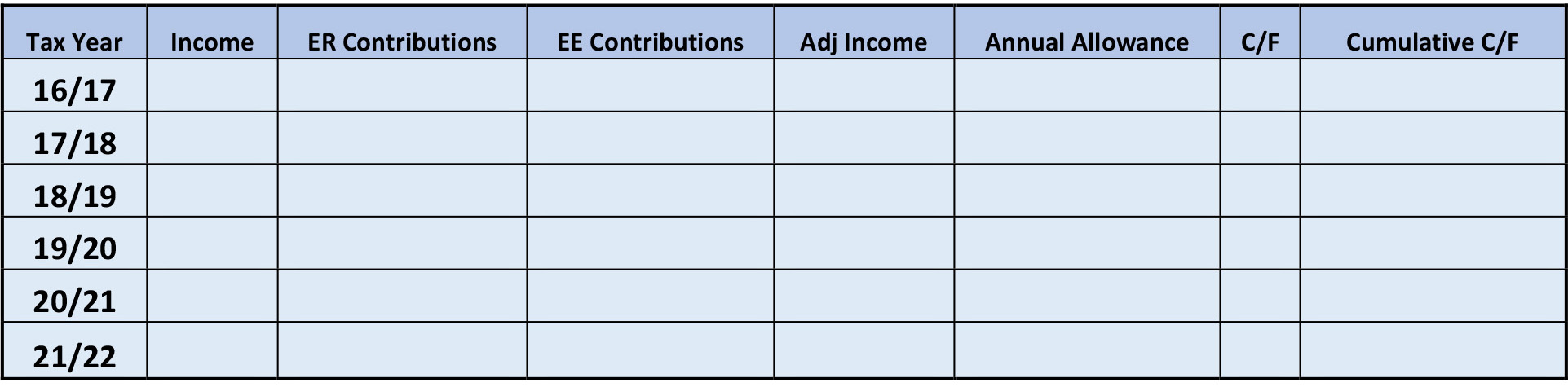

I use the following table to keep records of payments:

The cumulative carry forward column at the end is the amount of carry forward that is available in the next tax year. As can be seen from the carry forward figures it is only the balance of the tapering that can be utilised in the later years.

The above example highlights the need to collate and keep good records in respect of historic payments. The need to establish who paid the contributions has become imperative for high earners and clients who have multiple income sources. It is important to ask the question – What is your total income from all sources? This will include the following:

- salary, bonus,

- pension income (including state pension),

- taxable element of redundancy payments,

- taxable social security payments,

- trading profits,

- income from property (rental income),

- dividend income,

- onshore and offshore bond gains,

- taxable payment from a Purchased Life Annuity,

- interest from savings accounts held with banks, building societies, NS&I and Credit Unions,

- interest distributions from authorised unit trusts and open-ended investment companies,

- profit on government or company bonds which are issued at a discount or repayable at a premium and income from certain alternative finance arrangements etc.

As mentioned earlier, the raising of the Threshold/Adjusted Income should see a significant reduction in the number of client’s impacted by tapering. The tapered annual allowance is covered in greater detail:

https://www.gov.uk/hmrc-internal-manuals/pensions-tax-manual/ptm057100

The days of a large contributions being made at the Company’s year end needs very careful planning as I hope the above has demonstrated, a thorough collection of information is required.

When asked, how much can be paid into my pension this year?

My starting point is – How old are you? Have you encashed any of your pensions? And the rest of the information is dependant upon the answers to the above!!

This article highlights the implications of not analysing, planning, and carefully considering all the information you need to provide a recommendation.

The FCA want to see higher standards of advice and believe this can be achieved if PTS’s improve their levels of knowledge and understanding through formal training. There are new and specific CPD requirements in place for PTS’s and the Expert Pensions PTS Knowledge Hub is designed to provide you with insight, best practice, and technical refresh to ensure you maintain and enhance the knowledge and skills you need to deliver a professional service to your clients, your business, and the financial services industry.