I could have entitled this article – Are you using your Apprenticeship Levy? but I know, from the conversations I have had with a number of firms, a large percentage of the people reading this would have immediately stopped ‘Apprenticeships are for young people, the 16- 19 year olds,’ ‘ we’re not the kind of business that employs Apprentices.’

The word apprenticeship is a misnomer when it comes to using the funds that the Apprenticeship Levy takes from firms with a wage bill in excess of £3Million. For those of you who are not aware here are the facts:

- Firms with a salary bill in excess of £3M will make a single contribution of 0.5% of their payroll

- The levy payment will be deducted as part of the normal monthly direct payment made to HMRC via PAYE from April 2017.

- Firms can access funds from the 18th May through their own digital account.

- Firms will have 24 months to utilise their levy contributions at which point this will start to affect the amount available – think of the old adage – use it or lose it

- The Government will co- fund at a rate of 90% those firms that do not pay the levy or firms that pay the levy and want further ‘apprenticeships’ in excess of the levy funds they pay.

- Apprenticeship training and assessment must be with an approved training provider and assessment organisation.

- Only training providers on the Government register, RoATP, will be able to access levy funds for training.

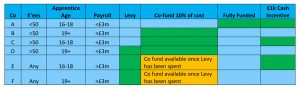

The table below simplifies the funding criteria

The most unappreciated aspect of the apprenticeship levy, and why I began the article in the way I did, is that levy funds will not be restricted in their use for new employees or young employees embarking on an Apprenticeship programme. If you understand the intricacies of the levy rules and regulations a firm can effectively use the levy or co-funding for the following:

New Employees – all new employees into the firm who embark on an apprenticeship.

From May 2017, this includes your graduate intake that are starting in a new role. This can be at levels 2, 3, 4 or 5 and Higher Degrees

This is a major opportunity for businesses across the UK to expand their L&D offer

Management Development

From April 2017 there has been no upper age limit on new apprentices. Think about using the levy for succession planning in line with the Senior Managers and Certification Regime. Your firm could run a three year, level 6 Leadership and Management Programme for those individuals identified as the next Senior Managers which gives the individuals the equivalent to a degree and the firm a group of people who are readily able to step into vacant positions rather than having to pay high recruitment fees for external recruits.

If you pay the levy a firm could claim £27,000 back for each person on that three year programme… and if you don’t or have spent your levy then the Government could fund 90% of the £27,000. In what other circumstances would you be given £24,300 for developing your employees on programmes tailored to suit your business requirements?

Re-skilling your existing workforce

If your firm has specific business needs you can re-skill your employees to address those needs using tailored Apprenticeship programmes.

Professional Qualifications

Using Apprenticeships to accredit professional qualifications as added value modules to your programme – CII, CISI, LIBF and Chartered Banker qualifications- it should be a part of all financial service apprenticeships.Apprenticeships can also be used for example on IT vendor qualifications such as Microsoft and CompTIA, Accountancy – AAT and progression onto full professional status, CIPD for HR and L&D professionals along with Digital marketing and social media units to add to the skillset of employees.

To ensure we balance the books in this article let’s just look at what the levy cannot be used for:

- Wages

- Statutory licenses to practice

- Travel and subsidiary costs

- Managerial costs

- Traineeships

- Work placement programmes

- The costs of setting up an apprenticeship programme.

This is a major opportunity for businesses across the UK to expand their L&D offer and budgets in a very cost effective way. Your commercial training budget will be affected negatively by the levy. As one client said to us ‘we can’t progress this training as we have to pay the levy.’ It is important for businesses to fully understand how they can deal with this new tax – why would you not want to use it to your advantage?

FSTP and 3aaa have been jointly working with businesses, offering a managed service, in the financial services sector to help them understand and interpret the Governments intentions for the levy.