Fitch Learning takes a closer look at International Financial Reporting Standard 9 (IFRS() and how it is reflected in the reports and accounts of banks and corporates – making suggestions about how advisers and analysts can unravel some of its complexities.

What is IFRS9?

IFRS 9 is a new international accounting standard on financial instruments that came into effect on the 1st January 2018. It applies to both financial institutions and corporates, requiring them to take a forward-looking approach to raising a credit loss provision (or impairment allowances) for potentially bad loans.

Under the previous accounting standard (IAS 39), firms actually had to incur a loss before they could act. In other words, a default had to occur before a loss provision could be recognised. However, even AAA-rated firms carry a probability of default.

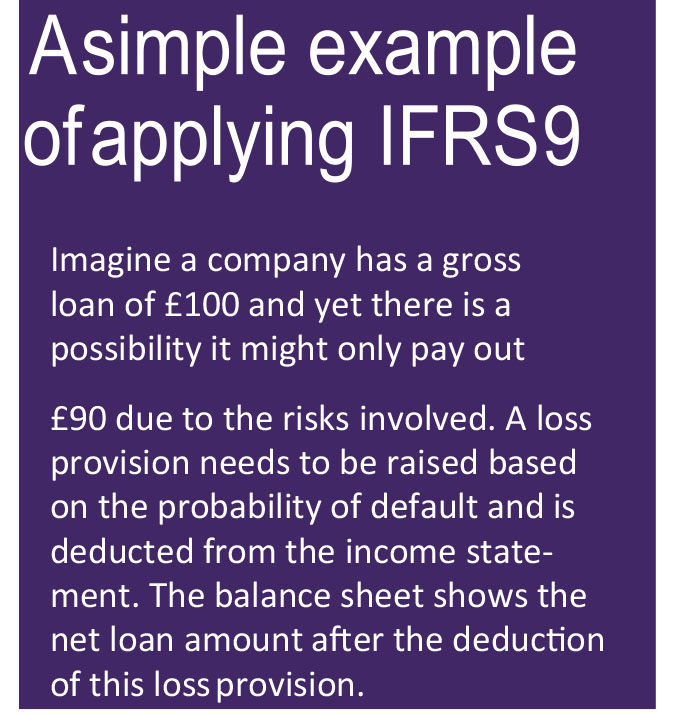

As such, financial institutions and corporates may now require a loss provision to be recognised against their risk exposure under the new IFRS9 – even though

there is no default at the reporting date. In effect, showing these loss provisions in the accounts is like putting money aside for a rainy day.

There are nuances and challenges around applying this new model, especially when considering forward looking macro- economic information, simply because it requires estimates and judgements

The complexities of IFRS9

The key changes in IFRS 9 for banks and similar financial institutions revolve around both the classification of financial assets and the application of an expected credit loss impairment model. What this means is that the classification of financial assets is not only based on the business model test, but also the nature of cash flows. The ‘principles-based’ nature of classification means that the same asset may be classified differently by different firms.

The provision for bad loans must now be reflected in a firm’s financial statements based on the expected credit loss model (as opposed to an incurred loss experience).

There are nuances and challenges around applying this new model, especially when considering forward looking macro- economic information, simply because it requires estimates and judgements.

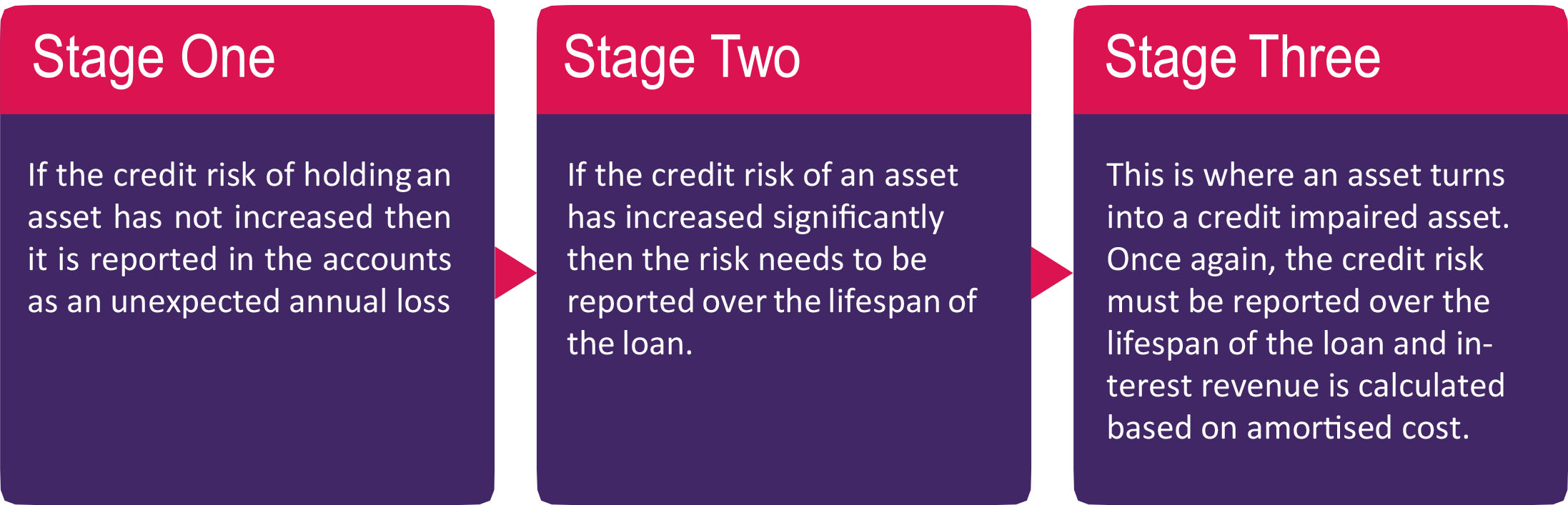

In terms of recognising the level of impairments of a financial asset, IFRS 9 uses a three-stage approach. Here, the amount of expected credit loss/loss provision is based upon whether or not the risk of an asset has increased significantly since the inception date. Where there has been a significant increase in credit risk, full lifetime expected credit losses are provided for, even though the asset is not actually credit-impaired.

The 3 Stage Expected Credit Loss (ECL) Model

In order to understand and analyse a bank’s financial statements for example, it is important to get to grips with how the three-stage expected credit loss model is applied. It is also crucial to understand the simplifications and practical expedients that could be used for smaller portfolios. In addition to classification and impairment changes, hedge accounting has also been made more ‘principles-based’.

As with most complex financial subjects, seeking an answer to your questions to IFRS 9 on Investopedia will only take you so far: simple definitions are unlikely to help you conduct a thorough analysis of any firm’s books.

Scenarios around the application of IFRS9

Let’s imagine a couple of scenarios. Say you are analysing a financial institution that has originated loans and that these loans are grouped into two types of portfolio:

- The first types of loans are those with standard terms. These are held to maturity and comprise a combination of both fixed and variable rate loans.

- The second group of loans also have standard terms. However, they are generally securitised after their origination

The question here is how would an entity classify these different types of loan under IRFS9? Additionally, how will the expected credit loss (ECL) impairment model be applied? We also need to consider what judgements and estimates may be required to apply the ECL model in the scenario above.

In another scenario there might be uncertainty around the macro-economic factors which impact IFRS 9 accounting. Let’s say you are scrutinising the financial statements of a bank which applies the three-stage ECL model to a portfolio of retail loans.

Say some of the loans within the bank’s portfolio are at variable interest rates, what happens to the level of the loss provision if the Bank of England raises interest rates? How do you work out the impact of this change in interest rates on the movements between the three stages of the ECL model? Would there be a movement to Stage 2 if there is good quality collateral? And as an analyst, how do you measure the credit loss provision or assess the sufficiency of current levels?

The risk of not understanding how IRFS9 is applied

The two relatively common scenarios above highlight some of the complexities around IFRS 9 reporting. Only by really understanding what the figures mean will you be able to fully comprehend how IFRS 9 is reported in a firm’s financial statements.

By not dedicating the time to understanding the nuance and complexities around how IFRS9 is applied in the financial statements, you run the risk of misunderstanding an entity’s financial position.