It has been estimated that there were about 500 claims management companies (CMCs) when the Access to Justice reforms took effect and the UK saw the introduction of ‘no win, no fee’. By 2010 this had risen to around 3,300 and concerns were rising about the complex way in which CMCs charged for their services and the amount of hidden fees and charges.

In April 2013 a ban on referral fees between CMCs, lawyers, insurers and others was introduced and some 1000 CMCs closed their doors. It is felt that those that survived had actively diversified into providing additional services such as vehicle recovery, storage, etc.

In its Spring Budget 2016 the Government announced further change in the transfer of responsibility for regulating the sector from the Ministry of Justice to the FCA on 1st April 2019. The House of Lords debate on the enabling legislation referred to poor outcomes for both consumers and businesses and there was acceptance that there had been an unacceptable fall in standards with a minority acting irresponsibly. One particular issue was the number of claims made which were unsubstantiated.

Regulation combined with the advent of SM&CR later this year should see the senior management of CMCs undertaking a root and branch review of their operations

Andrew Bailey, the CEO of the FCA, has stated “We want CMCs to be trusted providers of high quality, good value services that can truly help consumers. A key element of our approach to regulation will be ensuring that consumers are both protected and treated fairly.” Other intended outcomes of the move to FCA regulation were that CMCs would be more stable financially and that as a result there would be better protection for clients’ money.

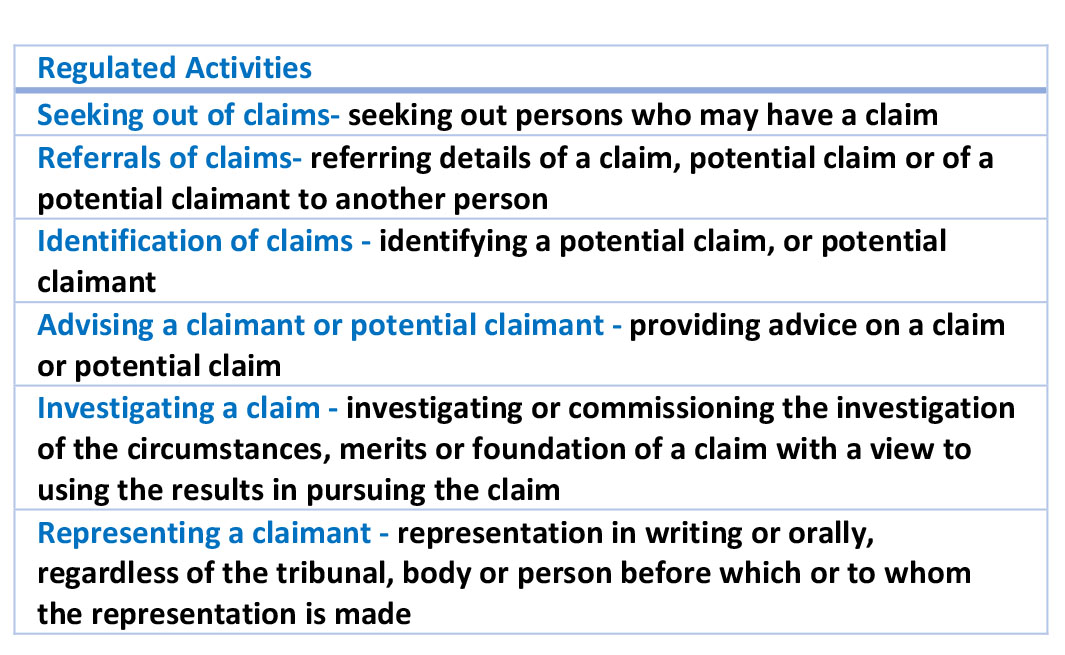

There are six areas of operation covered by FCA regulation of which three are likely to be relevant to TC News readers: personal injury, financial services and employment. (The others are housing disrepair, specified benefits and criminal injuries.) It is worth noting that the employment category includes claims in relation to wages, salaries and claims in relation to wrongful or unfair dismissal, redundancy, discrimination and harassment.

Three bullet points will illustrate the way in which regulators perceive the sector. The FCA has created rules to require CMCs to:

Three bullet points will illustrate the way in which regulators perceive the sector. The FCA has created rules to require CMCs to:

- avoid making speculative claims

- avoid using misleading advertising

- prevent high pressure selling

Their stated intention is that firms will act with honesty and integrity with an emphasis on getting things right. The FCA’s ability to fine firms for breaches or to withdraw authorisation is seen as a means of focusing the attention of CMCs. Regulation combined with the advent of SM&CR later this year should see the senior management of CMCs undertaking a root and branch review of their operations.

Following on from last year’s introduction of a cap on fees, the CMC sector is going through a period of significant change. This may cause concern for those working in the sector, particularly around the belief that some firms will withdraw – I understand that only some 519 CMCs have so far registered an interest in continuing to provide their service.

Surviving firms will have to change their procedures and for some their whole business model. Staff will need to be trained in new procedures including the introduction of a document given to customers when they agree a contact containing important information such as estimation of fees, overview of services provided by CMC’s, tasks customer will need to undertake themselves and where a statutory ombudsman or compensation scheme exists in relation to the claim, it must also include a statement confirming that the customer is not required to use the CMC to pursue the claim and may present the claim themselves and for free. Positioning this document will require an understanding of the objective so that it is not presented in a negative way which might lead clients not to read it.

Rules requiring regular updates on the progress of customers claims, recording of calls and having a clear and fair complaints policy will need to be implemented with appropriate staff training. Management will also need to understand their responsibility in terms of marketing, meeting prudential requirements, client money segregation, due diligence on lead generators as well as data protection.

While the above covers some specific issues that will impact on people and their roles, the key for the FCA is about how firms set their own culture. Leading from the top, senior management will have a responsibility to ensure that their staff policies from identifying the need for additional staff members, through recruitment and on to monitoring and development all focus on building the skills to deliver good outcomes to their clients.