Challenging Times

The FCA’s Conduct Risk and Strengthening Accountability agendas are making firms rethink how they ensure good outcomes across the entire customer journey. Formal T&C and QA processes are a key part of most firms’ defence against poor outcomes and, traditionally, these processes have focused on sales advice. Increasingly however, firms are introducing T&C and QA processes across a wider range of communities including collections and recoveries, account servicing and, importantly, complaint handling staff. However, as firms broaden the scope of T&C and QA, the cost is increasing. So how can a firm increase its control without this becoming bureaucratic and expensive? In other words, “how do you have your cake and eat it”?

In this article we’ll explain two, very different, approaches to managing T&C and QA across a firm and provide an example of how a major firm is adopting an innovative, risk based approach to its complaint handling community. Finally, we’ll explain how this risk based approach can be innovated to further improve both customer outcomes and reduce cost.

The routine approach to delivering T&C and QA

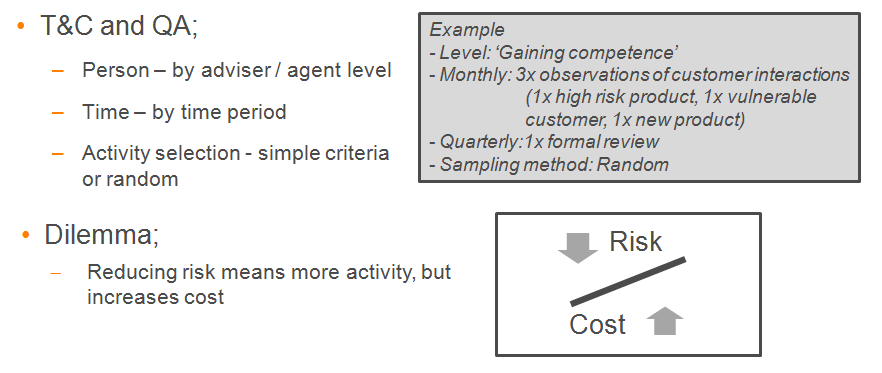

The most common way T&C and QA is delivered is through a mix of allocating people a level, e.g. ‘new joiner’, ‘gaining competence’ and ‘fully competent’, then assigning a number of activities for that level, e.g. T&C observations or case checks. Finally the actual activities are selected using some simple criteria, e.g. type of product or customer profile or, as is often the situation, activities are randomly selected. The challenge with this approach however is to exert more control on the risk posed across the customer journey directly impacts cost, (see diagram below);

In one example we encountered, a firm randomly selected only 2% of complaint handler calls to be checked from a QA perspective each month. The firm understood the risks this small sample sized posed, however, the issue they had was that increasing the sample size meant either more supervisors or compromising the quality of each review.

Clearly, the routine based approach has limitations.

Risk based approach to delivering T&C and QA

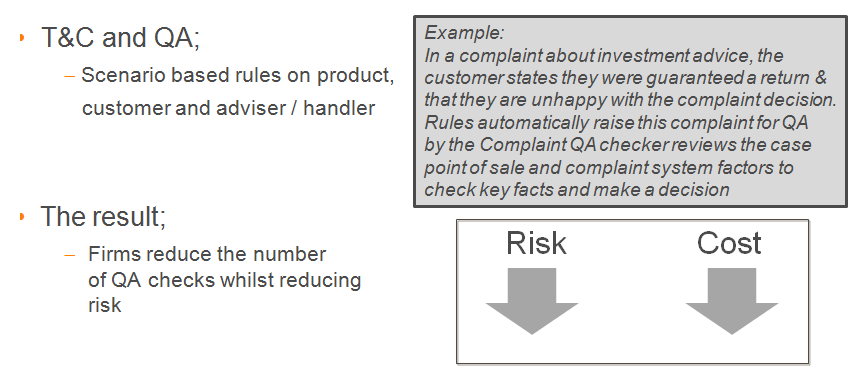

An alternative being adopted by a growing number of firms is to use risk based criteria to select which activities to QA and form part of T&C reviews. So what does a risk based approach look like? Typically the firm classifies adviser or handler customer interactions in terms of the risk posed to the customer. Risk criteria vary according to the community in question, however they are usually a mixture of criteria relating to customer type, product type and adviser / handler type.

To ensure the correct cases / customer interactions are identified, best practice runs these risk criteria, or risk rules, against the case management in question. For example, sales advice QA run the risk rules against firm’s Point of Sale system, complaint advice QA against the complaint case system etc. Rule sets vary enormously from a handful of simple rules that are independent of each other, e.g. is the case a complaint to the Chief Executive? Is the customer categorised by the firm as vulnerable? etc., to more complex rule sets that effect each other, e.g. Is the complaint handler inexperienced? Has the complaint handler had the minimum number of obligatory checks completed this month for that category of complaint? Best practice goes further and, using the rules, each QA check generates a series of questions that relate specifically to the that situation. If required, a simple initial set of questions can generate supplementary questions if the answer to any of the initial questions is a ‘no’.

Consequently, through integration with case management systems firms can be confident they are checking the customer interactions that pose the greatest risk to customer detriment and, by using case specific question bank technology, firms drive consistency into the actual checking process itself (see diagram below);

If the QA process identifies the need for remedial action, these actions are automatically routed to the person or team. Best practice embeds these remedial actions in the company’s T&C processes as doing so ensures that they are not lost and, importantly, become part of the regular one-to-one discussions between staff member and supervisor, plus ensures clear ‘line of sight’ between the original risk, the remedial action and the final result.

This enables the firm to evaluate the customer’s understanding of and feelings as a result of their interactions with the firm

Monitoring remedial activity enables the supervisory team in the relevant area to have oversight of progress. As such, they can identify trends and recurring issues feed this back into adviser / handler training.

Emerging Trends

Using the same risk based tools, the QA process can also identify key customers to survey to further validate the internal QA assessments. A worklist of QA calls to make are allocated to contact centre teams. Each QA check in the worklist not only has the necessary background information, it also has the specific questions to ask the customer. This enables the firm to evaluate the customer’s understanding of and feelings as a result of their interactions with the firm. Outbound calling is becoming an increasingly important tool for firms as they come to terms with the FCA’s focus on behavioural economics as a key new element of their assessment of customer outcomes. When used well, these outbound processes provide valuable information into both to an adviser / handler’s T&C discussions and to departmental performance dashboards.

Finally with the growth in recording adviser / handler customer interactions and the development of interrogative software, in addition to interfacing with point of sale and case management systems, audio of customer transactions can be analysed for key words, tone and sentiment. Having this information enables far greater precision of case selection and, enables the time taken to complete a check to be significantly reduced. For example, when reviewing the quality of the advice given by mortgage advisers not only can the appropriate case be identified for checking, the audio interrogative software can point the QA checker the appropriate parts of the call recordings to review. For one firm, mortgage advice calls from their contact centre could take several hours. Audio interrogative software would enable check times to be reduced significantly.

Conclusion

As the FCA ramps up its focus on customer outcomes, firms need to provide QA checks across the entire customer journey. Routine based approaches to QA and subsequent T&C discussions are either very costly or carry high levels of exposure to risk. Risk based approaches enable the simple binary choice of cost or risk to be broken and provide high levels of risk control due to the being very focused on which cases / interactions to check.

Looking to the future, the ability to interrogate audio recordings enables not only further pin pointing of which cases / interactions to check, but further reduces the time taken to undertaken each check.

A director from the collections and recoveries area of a leading retail bank was recently asked two questions by the FCA; ‘how can you be confident that you are delivering the best outcomes for your mortgage customers in arrears?’ and ‘how do you know?’ Risk based QA, linked to T&C schemes and performance dashboards answer the regulator’s questions.