Jeff Abbott looks at the increased accountability regulations focusing on the certification regime and what we need to do to prepare

Increased Accountability

The Parliamentary Commission on Banking Standards (PCBS) recommended a number of changes to provide greater precision about individual responsibilities. The Banking Reform Act of 2013 created the legislative framework for the changes to be introduced.

Initially the changes introduced as part of the Increased Accountability Regulations will only affect Banks, Building Societies, Credit Unions, Incoming Branches of overseas banks and PRA designated investment firms. Collectively these are referred to as Relevant Authorised Persons (RAP).

The changes introduce 3 tiers of regulation namely

The Senior Management Regime (SMR), Certification Regime and Code of Conduct (C-CON).

The existing Approved Persons regime is being replaced with the SMR and Certification Regime. Specifically, the PRA and FCA wish to continue to pre approve the appointment of Senior Management Functions (SMF) with a company but pass on the responsibility of approval to firms themselves for people who fall within the certification regime.

The new list of SMFs is narrower than the existing Significant Influence Functions(SIFs). The regulators will take an active role in their approval. They will not require to pre approve anyone falling within the Certification Regime but reserve the right to challenge the process of approval used by the authorised firms.

The regulators have created a list of prescribed responsibilities to be allocated amongst the SMFs. It is a requirement that each firm ensures that each SMF has a clear statement of responsibility(SoR) to provide absolute clarity of their role. Each firm is also expected to produce a responsibilities map which they keep up to date to ensure there are no gaps in regulatory responsibilities.

The certification regime covers specific PRA material risk takers(MRT) and FCA Significant Harm Functions (SHF) which are roles that are deemed capable of posing higher levels of risk to the FCA achieving their objectives and consumer outcomes. The list of people in scope includes previous SIFs that are not included in the scope of the SMFs as well as people who require qualifications as part of their role -this includes financial advisers

In order to be certified individuals will need to have been trained on the new Code of Conduct(C-CON) and be deemed Fit and Proper using the requirements within the FIT sourcebook.

The code of conduct replaces the approved persons code (APER) and applies to all staff with a few exceptions. There are 2 main tiers of conduct rules. The first tier comprises 5 rules (CR 1-5) that apply to everyone in scope. The second tier apply to SMFs only (SM1-4). However, the introduction of the code is staggered.

The SMR and Certification Regime started on 7 March 2016 – at this time SMFs were in place and the audience falling in scope of the certification regime were to be identified. Both these groups have been subject to the code of conduct from this date and must have received training to ensure they fully understand its requirements and application

Certificates for people need to be issued by 7 March 2017 by which time the remaining people falling in scope of the code of conduct must have been trained for full implementation.

The Treasury has announced intention to spread the requirement of the increased accountability regulations across the financial service industry by 2018

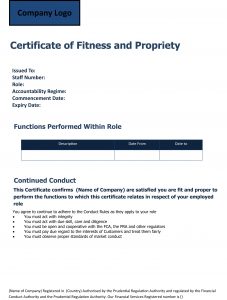

Sample Certificates that can be used under the Certification Regime

Prepare for Change

All firms will be affected by these changes (subject to consultation process) from 2018.

There is no doubt that building an understanding and a correct interpretation of the regulations is key to successful implication.

Why not become a T-CNews subscriber to help develop the key elements and find out how different companies and experts have tackled the key challenges.

In the special compilation edition of the magazine on the right we have showcased some of the articles that have been published over the recent times. Perhaps this will persuade you to become a subscriber?

How about an In-House Workshop to prepare people?

Getting to Grips with the Certification Regime is just one on the workshops available under our in-house option. Briefing your people will encourage debate, identify issues and give you more time to prepare

Arrange a Certification Regime Health-check

Having undertaken T&C Health-checks for firms over the years we are very confident of our ability to look at the approached you have developed in response to the requirements of the Certification Regime and Code of Conduct.

If you would like peace of mind then why not ask for a Certification Review? We will look at all the following aspects for you and grade your approach Green, Amber or Red.

- Governance

- Reporting & Controls

- Certification Issue

- Scope

- Competence Approaches

- Remuneration & Reward

- Recruitment & Referencing

- Code of Conduct

Email: info@2bedevelopmentconsultancy.com or call 01361 315 003

Ready to deal with our Dear SMF letter?

If you think you are ready to stand up to any regulatory scrutiny of your Certification Regime arrangements please view our Dear SMF letter by clicking the image below.

If having read the letter you feel you would benefit from talking to us please get in touch. Email info@2bedevelopmentconsultancy.com