In this article Julie Pardy from Worksmart takes a closer look at how firms might deal with the requirements of the certification regime whilst under lockdown.

It has been said a thousand times, but these are times like we’ve never known before. Many things we took for granted have changed, possibly forever, and other things have quickly become part of the new normal. One thing is clear however, business life has become tougher. As lockdown is gradually lifted, it will be interesting to see what pattern working life will take and how financial services firms will face up to the challenges created by CV-19.

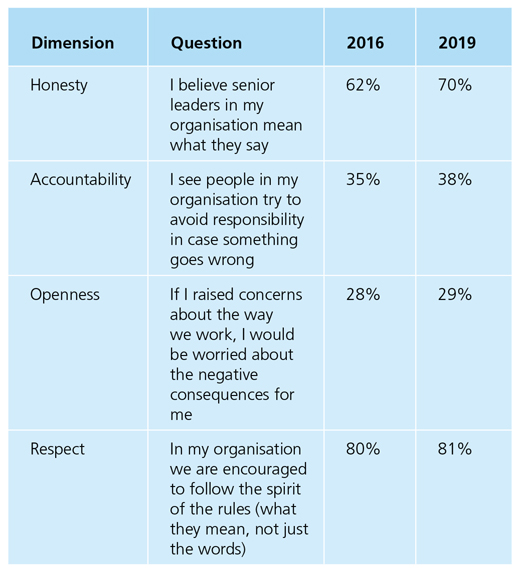

Even before the crisis, the industry was regularly challenged by the FCA around culture, leadership and generally improving conduct amongst firms. The results of the Banking Standards Board’s annual survey on behaviour, competence and culture in late 2019 identified that, whilst firms were making progress in some areas since the surveys began in 2016, the general trend was that of an industry ‘moving sideways.’’ To put that comment into context, consider this compare and contrast of survey questions from 2016 – 2019.

The FCA’s 2020-21 Business Plan made it clear that one of the FCA’s priorities was ensuring that firms and individuals behaved to the highest professional standards and that it would maintain a strong interest in firms’ culture, and in particular a firms’; purpose, leadership, people policies and governance. No doubt they will be interested to see what the results of the BSB’s 2020 survey will show them.

Guidance from the FCA

Against this backdrop, people responsible for managing firms’ SM&CR regimes are faced with a number of operational challenges and as a result, tough choices. As you would expect, the FCA has issued guidance across many areas of regulation, and SM&CR and its application have been given a fair share of flexibility in a number of these communications. For instance, the FCA has extended the time period individuals can hold Senior Management Functions (SMF’s) on a temporary basis from 4 to 12 weeks (within Solo- Regulated Firms). In addition, those individuals captured by T & C related CPD requirements have seen greater flexibility handed to them if they are unable to achieve their required hours as a result of the pandemic during 2020. Alongside new flexibility around CPD, the existing requirement to achieve relevant qualifications within a 48-month period has seen an extension that will effectively allow individuals up to 60 months to achieve relevant qualifications, subject to the employing firm’s agreement. This concession has been given to take into account that many professional bodies have cancelled planned examination sittings in light of CV-19. Whilst relaxing the rules around CPD and qualifications could be argued to pose potential risks to firms and customers, they absolutely make sense in the current climate and come with obvious operational benefits.

The most consistent piece of feedback we received from our banking clients who undertook their first Certification assessments back in late 2016, early 2017, was that if they had their preparation time again, they would most definitely have run a trial certification process

However, whilst relaxing these factors the FCA has remained resolute that the on-going assessment of Fitness and Propriety is a critical check and one that needs to remain in place. To make the point, the CV-19 guidance for dual regulated firms, from the FCA is:-

“Firms should continue to take reasonable steps to complete any annual certifications of employees that are due to expire while coronavirus restrictions are in place. We understand it may be necessary to adjust standard certification processes and policies. And we recognise that what constitute reasonable steps may be altered by the current circumstances. However, even in these circumstances, Certified staff who are not fit and proper should not be re-certified. Certification is an important mechanism for firms to ensure their critical people are fit and proper. It is even more important now for the public to be able to trust in the individuals delivering critical financial services.”

The lack of a formal statement of this nature for solo-regulated firms may be because the first round of certification is not due until December 2020. Nonetheless, the absence of extending the flexibility given to CPD and qualifications can’t be helpful for those responsible for certification in solo-regulated firms where resources needed to undertake these assessments may be thin on the ground. Talking to our clients I know that greater clarity around other elements of CV-19 would be welcomed for example, e.g. what is the guidance for conducting fit and proper reviews with furloughed staff?

The Wider Working Situation

Then of course there are the day to day realities of working life today. Research undertaken by YouGov on behalf of the CIPD in April 2020 identified that 21% of those surveyed had been furloughed and of the remaining 79%, six out of ten were working from home. 30% of respondents said their ability to work has been impacted by a change in caring responsibilities since the outbreak, e.g. home-schooling, caring for vulnerable relatives etc. And, worryingly, 43% of respondents said their mental health had deteriorated since the crisis began and a further 35% said their physical health had been impacted. These results paint a tough picture for those responsible for certification and fit and proper in particular as firms struggle to manage with less staff and staff who may not be able to operate as effectively as before.

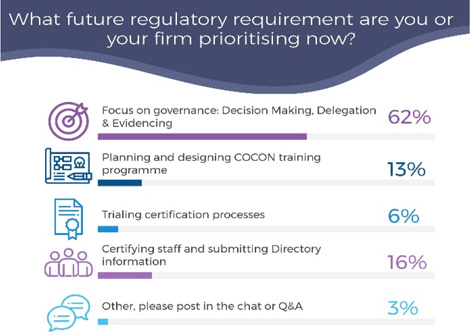

And finally, these challenges may be made even harder by priorities within the teams responsible for managing their internal certification regime during lockdown. For example, in a recent survey conducted during a webinar of over 100 HR, compliance and T&C professionals one of the questions was about priorities. Admittedly this survey is only as snapshot from a single group of individuals. However, it does shed light on firm’s priorities regarding SM&CR, and even though the Certification deadline is only December 2020, it would appear that the majority are still focused more on the Senior Managers element of the regime.

Not surprising that during a crisis, governance and decision making are key within firms, however if this result is indicative of the wider industry, then there may be considerable challenges to completing the certification process to the standards expected by the FCA in December 2020.

Managing the Certification process

In the absence of any change to the guidance for solo-regulated firms, it should be assumed that the deadline for completion of the first round of certification by 9th December 2020 remains.

It seems to me that there are many significant challenges for firms implementing their Certification regimes for the first time. From ensuring that firms have the right staff in scope, that the range of data and evidence to be used has been well thought through and is accessible come assessment time, all the way through to clarity about consistency of assessment processes and the sign off process itself. There is a lot riding on this from a regulatory perspective and the FCA will be watching with interest! The most consistent piece of feedback we received from our banking clients who undertook their first Certification assessments back in late 2016, early 2017, was that if they had their preparation time again, they would most definitely have run a “trial certification process”. The reason for this they tell us is to give them the opportunity to understand what did work, what didn’t work and where it would be prudent to refine intended processes.

Fitness and Propriety

It would appear from our work across the sectors that Fitness & Propriety means many different things within firms and is used interchangeably by many around the financial soundness element of the assessments. These different interpretations mean that it is worth taking the time to go back to basics and consider the actual FCA definitions in a bit more detail. Taking each component of the fit and proper assessment in turn:

Honesty, Integrity & Reputation:

This requires firms to check whether individuals have the ‘honesty, integrity and reputation’ to work in the industry and carry out their role.

From a regulatory perspective, the FCA are looking for firms to identify, through background checks, whether the individual might be suitable for the role that they are being considered for. This will include mandated Criminal Record Checks for those undertaking Senior Manager roles, and over the last few years, a growing number of firms also mandating these for Certified staff.

Through the regulatory reference process identified as a requirement for Certified staff, firms are expected to consider their past employment history and whether through this assessment whether any adverse employment history might exist.

Competence and Capability:

This requires firms to ensure individuals have the competence and capability to undertake the role that they are being employed for. This is likely to include research around an individual’s past experience, qualifications, CPD and history in relation to previous connected roles.

Although competence and capability assessments can use a range of data to assess competence, e.g. T&C records, performance management, HR records, CPD etc., in the current situation firms may need to decide which set of data constitutes the minimum requirement. Typically, within the banking sector organisations will pull data from a wide range of areas as noted above, however against the current backdrop, it may be that firms will not have the widest range of complete data to call on. In this instance, it would be prudent for senior managers to undertake an assessment of the impact of CV-19 and home working on their evidence processes and note down the logic and rationale for any narrower assessment criteria they settle on.

Financial Soundness:

This requires firms to check whether the individual’s finances may influence their ability to undertake their role. At its most basic level, firms should check the individuals’ position with regards to debt or bankruptcy proceedings against them.

Beyond that the FCA states that in FIT 2.3 (G) that they “will not normally require a candidate to supply a statement of assets or liabilities. The fact that a person may be of limited financial means will not in itself, affect their suitability to perform a controlled function.” In our experience, many firms however do require individuals to supply a summary list of assets and liabilities periodically with a statement each year listing any demonstrable changes.

In the current situation, firms will have to consider whether they are prepared to consider a narrower assessment around assets and liabilities, with a commitment to undertake a fuller review next year. Bearing in mind though that for many individuals this will be the first time that they have been assessed under the Fitness & Propriety rules, employers may be reluctant to take a lesser that full approach. However, there will be a Senior Manager(s) within each firm who has the regulatory accountability for Certification and therefore as a 1st step, engaging the Senior Manager in the operational challenges would be a wise starting point.

Looking beyond fit and proper to the other key activities in the certification process:

Conduct Rules Training:

The regulator expects all Conduct Rules training to be “role relevant”, so how do firms do that? If firms are using on-line learning, this is a great first step for general awareness, but if the material is not aligned to the sector that you operate in and the roles that you undertake, then this will very likely fall short of regulatory expectations. Having conduct rules training online however via Microsoft Teams, Zoom Rooms, led by managers with case study type scenarios appropriate for the audience will enable individuals to complete the training remotely. By adhering to the “role relevance” expectations, this should allow the training to make much more sense to individuals as it brings alive the rule requirements, but with the context of fitting into the roles that individuals actually undertake.

One of the good things emerging from the CV-19 crisis has been the acceleration of trends that were already happening. For example, homeworking has been a major success for many, largely by increasing our use of technologies such as Zoom and Microsoft Teams. Increasing the use of technology to help manage certification process will save time for individuals and managers plus ease the burden of central oversight.

The upside of the difficult situation we find ourselves in is that it gives us permission to look at things with a fresh pair of eyes. When we get back to normal (whatever that new normal looks like) let’s hope that firms take time to consider how their 2020 certification process can be streamlined. We have all learnt more so now than ever before that technology can make our working lives more efficient and effective. Post pandemic, perhaps there is a case for seeing the “glass as half full, not half empty” and utilising technology more to ease the complexity of processes such as Certification.