It’s nearly two years since the FCA launched SMCR and SIMR. The intention was to put individual responsibility at the heart of how regulated firms conduct themselves. So how well have firms coped with these significant changes? Have senior managers changed their behaviours? And what can the huge swathe of smaller firms that have yet to face SMCR learn from those that have?

In conjunction with T-CNews, The Patterson Group set out to find some answers to these questions. We asked firms who are already subject to SMCR/SIMR about their experience, and asked those preparing for SMCR for their views. To encourage the most open responses from both populations, responses could be completed anonymously (which just less than half chose to do). The results of this are shown below. Both surveys, hopefully, provide a good snapshot of the perceptions of people on the impact of SMCR.

Firms that are already subject to SMCR/SIMR

The types of firms who responded in this population were predominantly the larger banks and building societies.

As SMCR/SIMR is intended to strengthen consumer protection by increasing the personal accountability of staff across the organisation and through strengthened governance processes, we started by exploring this fundamental area. What we found was a largely positive picture. Although it wasn’t the case in every firm, an impressive 86% of respondents either agreed or strongly agreed that this has indeed been the case.

There is sometimes a perception, especially in larger firms, that senior management is remote and a little distant from day-to-day activities. So we asked whether people felt that senior managers had a good awareness of key elements of SMCR. For example, are they aware of the certification requirements, annual fit and proper checks, prescribed responsibilities and the need for staff to demonstrate their competence? The results showed again that the leadership team deserve a congratulatory pat on the back. All respondents either agreed or strongly agreed.

To balance this, firms new to SMCR may be under-estimating the challenges in three areas: defining and allocating prescribed functions, determining what conduct looks like, and proving people are competent.

So far, so good. In our next question, we asked whether meeting the SMCR requirements had been a significant cost. Based on the respondents, it’s clear that the experience of firms differed quite markedly. When asked about this, 57% either agreed or strongly agreed that introducing it had been a significant cost whilst 43% disagreed. So what do we make of this? Well if this accurately reflects the broader picture, the most likely reason could be that different firms began from different starting points. For example, those firms with robust performance management systems (that enabled firms to define and measure competence) probably benefitted from the previous investment in this area whilst others didn’t.

So over half the respondents thought SMCR was a significant cost to them. How well did they do with this investment? Job done? Although not unanimous, the answer is mostly ‘yes’ with 86% saying they do not anticipate having to make significant changes going forward.

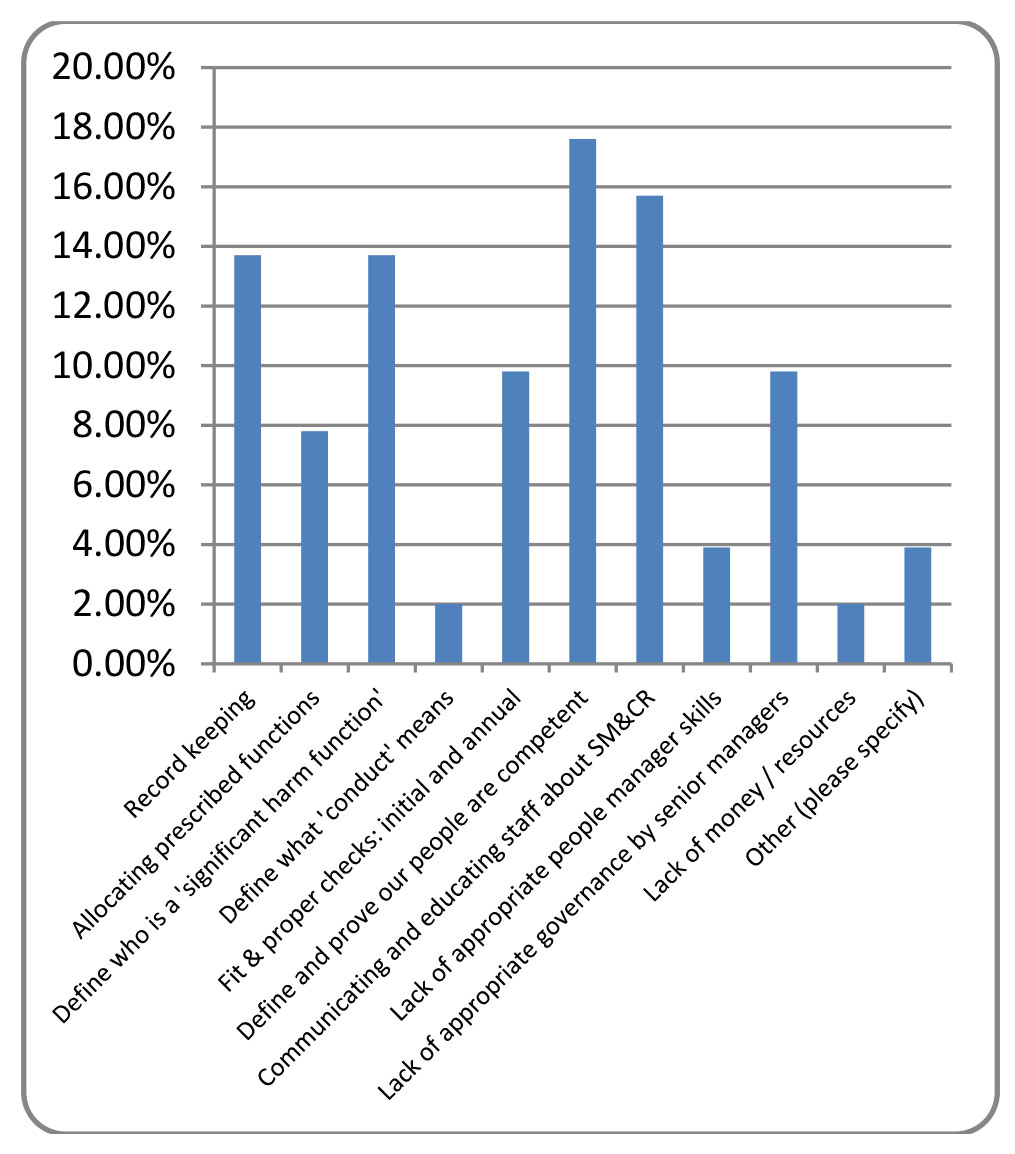

A key reason for embarking on this survey was to use the experience of those who have been through SMCR to help those who haven’t. So with this in mind, we asked respondents to identify what they believe have been their three biggest challenges when introducing SMCR. The results to this question are shown in Figure 1 below:

There were clearly a range of different challenges but three key trends emerge:

- Defining the roles and responsibilities of those people who are ‘in scope’;

- Communicating SMCR to staff; and

- How you determine (and prove) your people are competent.

This last point was the respondents’ clear favourite. This is likely to include things like defining job roles or job descriptions, and how to define and evidence competence.

I must admit that I was a little surprised that ‘record keeping’ and ‘lack of resources/money’ weren’t more prominent but this might reflect the fact that it was predominantly the larger firms, who you would expect to have resources, who responded.

Firms that are not yet subject to SMCR

As we know, SMCR is expected to be extended to all authorised firms towards the end of 2018. With this in mind, the next few months will be crucial in planning the implementation of this. A second survey asked firms who are not yet covered by SMCR to comment on how they view these requirements and their plans for meeting them. The most frequent type of firms who responded were asset and wealth managers, but there were also investment adviser firms, an EB consultancy and an insurance broker.

SMCR will apply to firms irrespective of size so we felt it was important to know the size of firms who were responding. We defined small firms as 1-10 employees, medium firms as 11-50 and larger firms as 51 employees or more. 76% of those who responded worked for larger firms, 24% for medium sized firms and, interestingly, there were no responses from small firms. This could possibly indicate that their awareness of SMCR is lower and they felt less able to comment on it.

We were keen to get the respondents views on the awareness levels of senior management to the key elements of SMCR. The survey found that, by and large, respondents felt senior management understood the key issues. Not surprisingly, this understanding was a little lower than those in larger firms that have already been through SMCR. That said, a respectable 82% of respondents agreed or strongly agreed that management grasped the key issues; only 18% of respondents did not.

We again asked about the perceived expense of meeting SMCR. The results were broadly similar to the firms who had already been through the process so this suggests that this population have a realistic expectation of what they are about to face. 65% believe that SMCR will represent a significant cost to their business. This is slightly higher than the existing firms but this probably reflects the fact that smaller businesses are less likely to already have in-house expertise, or systems and processes in place.

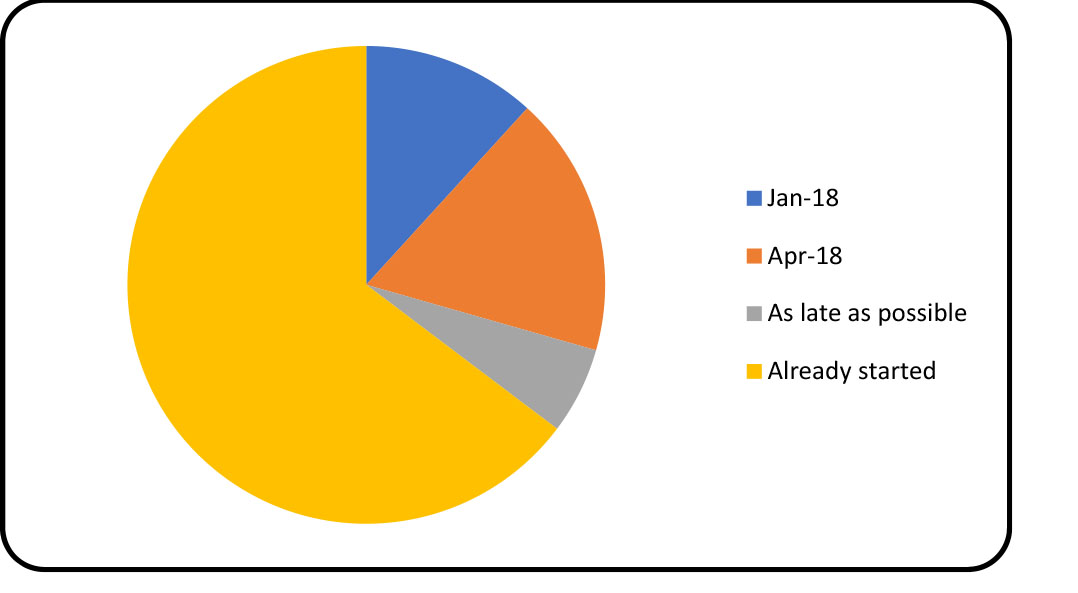

So, how long do we have to prepare for SMCR? The FCA has indicated it is likely to be Q4 in 2018 so we could have only another 8 months. Getting the planning right for the banks and insurers was certainly a challenge in 2016 so we asked firms how planning is progressing for those that will come in-scope in 2018. We asked them when preparations are likely to start. Figure 2 shows the responses.

This suggests a broadly encouraging picture where around two thirds of firms appear to have already started preparations. A resounding majority of respondents answered another question saying they are confident they will be ready in time. Having said that, around a third said they have not yet started their preparations and the same amount said their firm didn’t have a plan in place to meet the SMCR requirements. Given what SMCR will require firms to deliver, what is involved should not be underestimated.

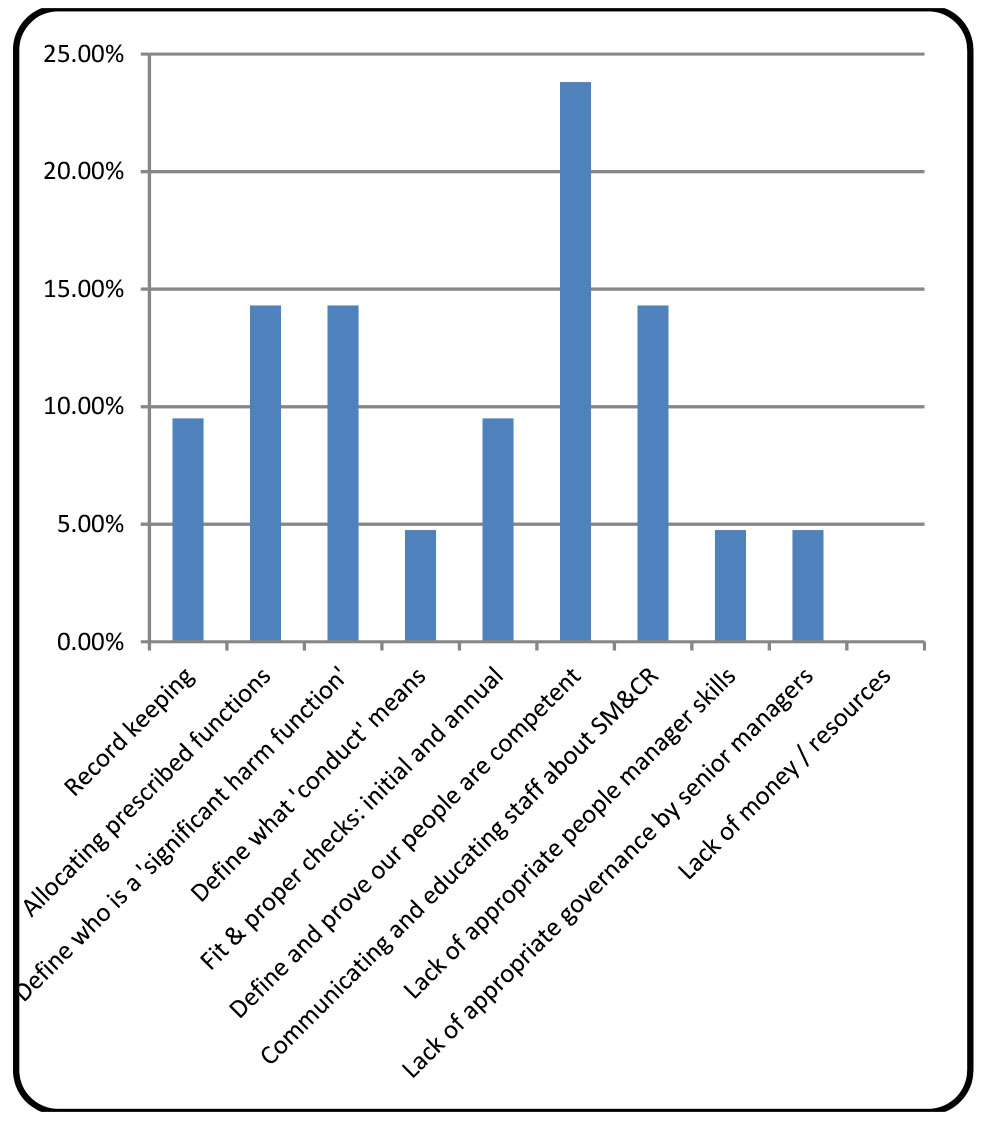

Finally, we asked respondents what they thought the three main challenges would be in introducing SMCR in their firm. This is identical to the question we asked those firms already subject to SMCR so I will look at the key differences. There were three areas where firms that have yet to experience SMCR may be over-estimating the challenges that potentially lie ahead. These areas are: record keeping, the governance provided by senior management and the lack of money or resource. To balance this, firms new to SMCR may be under-estimating the challenges in three areas: defining and allocating prescribed functions, determining what conduct looks like, and proving people are competent. All three areas have undoubtedly been a challenge for the existing firms so it is possible that firms new to SMCR need to concentrate more in these areas. The full details are shown in figure 3.

Conclusions

The research suggests that SMCR/SIMR has been successful with existing firms in achieving what the FCA wanted, i.e. strengthening consumer protection by increasing the personal accountability of staff across the organisation and through strengthened governance processes. However, this has been achieved at a cost and those firms who are yet to experience SMCR also expect it to result in significant additional costs. Many are already planning for the introduction of SMCR but around a third of firms have yet to start and do not yet have a plan in place. There may also be a question of ‘not knowing what you don’t know’. The research flags up three areas where firms new to SMCR may be under-estimating the challenges that lie ahead. Overall, the research suggests a generally positive picture with work still to do. Time will tell.